Bitcoin Market Sentiment Shift: What It Means for Investors

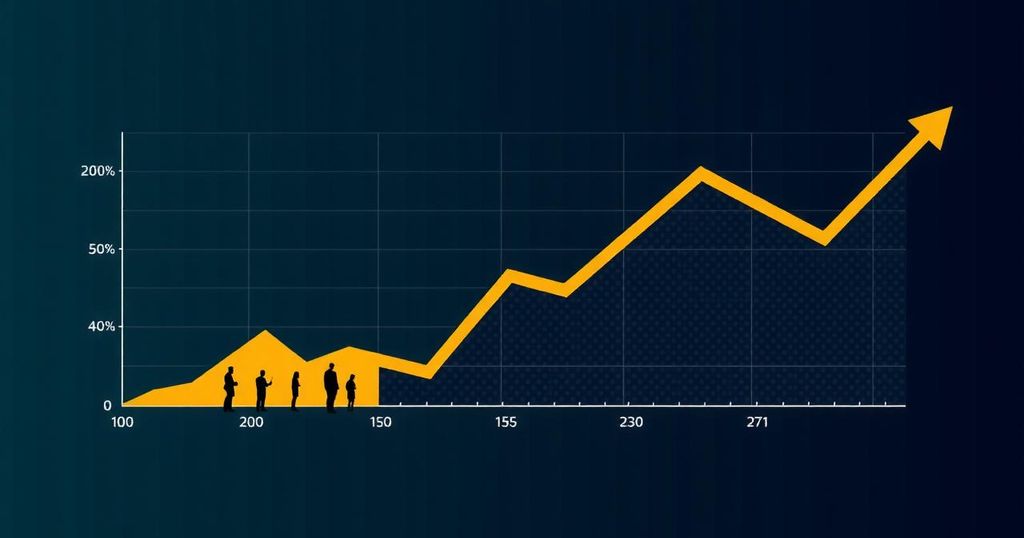

A recent report by CryptoQuant has revealed that Bitcoin funding rates on Binance, one of the largest cryptocurrency exchanges globally, have decreased to their lowest levels this year. This significant decrease in funding rates indicates a major shift in market sentiment, with short positions surpassing long positions.

EgyHash, an onchain analyst at CryptoQuant, highlighted that the last time such a bearish shift was observed was in October 2023, signifying a prevailing belief that the price of Bitcoin will decline. The funding rates on Binance have long served as a crucial indicator of market sentiment, signaling the balance between short and long positions.

When funding rates become negative, as is presently the case, it signifies that traders with short positions are paying those with long positions. This points to a higher demand for short positions, reflecting a pessimistic outlook on Bitcoin’s price in the short term.

Based on EgyHash’s data, the current funding rates have reached the highest level of negativity thus far this year. Furthermore, the average Bitcoin funding rate indicator, which aggregates funding rates from all exchanges, has also turned negative, indicating an overall bearish shift in the market.

A report by 10x Research on August 16 further bolstered this bearish sentiment by highlighting a lack of institutional interest in Bitcoin at its current price levels. The report cited the seven-day minting ratio, a stablecoin metric considered a reliable indicator of Bitcoin buyer activity, to support its assessment of institutional sentiment.

Markus Thielen, the founder of 10x Research, emphasized that stablecoin inflows are a key sign of fiat dollars being converted into crypto and then moved into Bitcoin or Ether. This lack of institutional interest has been particularly evident as of late.

Despite the negative funding rates, spot Bitcoin exchange-traded funds (ETFs) saw positive inflows on August 15, with a total of $11.11 million flowing in. This increase in demand from institutional and retail investors for BTC through ETFs suggests that Bitcoin is still viewed as a viable digital asset for crypto exposure.

While the recent market sentiment has been predominantly bearish, it is important for investors to consider all factors when making investment decisions. The cryptocurrency market is highly volatile, and market sentiment can change rapidly. Therefore, it is crucial for investors to conduct thorough research and seek advice from financial professionals before making any investment decisions.

Post Comment