The Impact of ETF Inflows on Bitcoin Price Movement

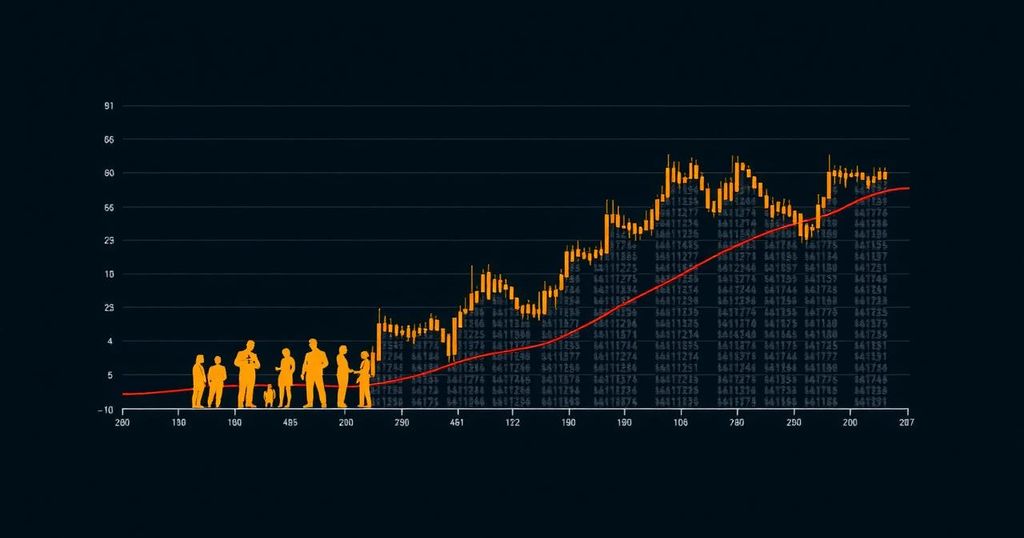

Bitcoin is once again approaching the $60,000 resistance, driven by a substantial influx of $11.11 million into BTC ETFs. This surge in popularity of Bitcoin and Ethereum ETFs managed by BlackRock has exceeded Grayscale ETFs, accumulating a total of $21.21 billion in assets. Upon closer examination, technical data indicates a potential obstacle at $64,500, with the IOMAP model pointing to a significant volume of 941.32k BTC in this range.

The recent positive trend in Bitcoin ETF inflows has played a crucial role in keeping the price of Bitcoin above $58,000. Data from SoSoValue shows a daily net inflow of $11.11 million into Bitcoin ETFs, resulting in a cumulative net inflow of $17.33 billion across 12 ETF operators. This upward trajectory in ETF inflows is expected to strengthen bullish momentum in the market.

BlackRock’s ETFs, specifically IBIT and ETHA, have emerged as leaders, outperforming Grayscale’s products and securing $21.21 billion in assets, surpassing Grayscale’s $21.2 billion managed across GBTC, BTC Mini, ETHE, and ETH Mini. This success for BlackRock represents a significant shift in the ETF landscape.

While optimism surrounds ETF inflows, it is important to recognize the complexities of the derivatives market, which may present mixed signals for short-term growth. While bitcoin price futures open interest decreased by 2% to $29.41 billion, options open interest also decreased by 4.32% to $20.19 billion on Coinglass. The increase in trading volume by 28% to $74.91 billion indicates a rise in market activity.

Rising volume alongside diminishing open interest and options OI may signal a market top or distribution phase for Bitcoin, potentially leading to increased price volatility and the possibility of a correction. Despite these challenges, the positive ETF inflows are expected to stimulate increased demand for Bitcoin, potentially driving its price to break through the $62,000 resistance and surge by 8% to $66,376.

As noted by the fear and greed index, which currently sits at 27, indicating fear in the market, discerning investors are taking advantage of the opportunity to accumulate Bitcoin during periods of market uncertainty. While this fear persists, investors are anticipating a larger breakout as evidenced by the recent increase in BTC ETF inflows.

However, the road to recovery for Bitcoin price may face resistance between $63,800 and $65,540. The IOMAP model highlights the presence of 1.62 million addresses that collectively purchased 941.32k BTC within this range, suggesting the potential for selling pressure that could halt the rally towards $70,000. On the other hand, support levels appear to be diminishing, with the strongest support identified around $55,843.

In conclusion, the influx of ETF investments has significantly influenced the trajectory of Bitcoin’s price movement. While the market faces uncertainties, the positive ETF inflows signal an underlying demand for Bitcoin, acting as a potential catalyst for the upward momentum of its price. As we continue to monitor the market, it is vital to remain mindful of the balance between positive ETF inflows and the challenges posed by the derivatives market.

Post Comment