Analyzing Bitcoin’s Market Value: Is It Time to Worry?

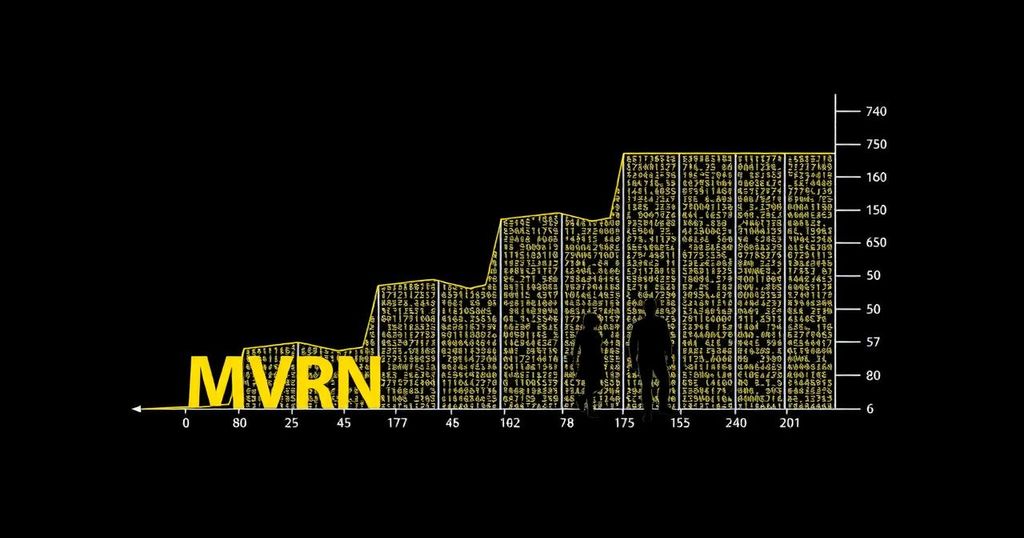

The recent decline in the value of Bitcoin has prompted many investors to question whether the cryptocurrency is moving into a bearish phase. Notably, Ali Martinez, a prominent analyst in the field of cryptocurrency, has observed that the MVRV ratio has fallen below the 1-year simple moving average, indicating a significant shift in the market cycle.

The MVRV Momentum indicator, which combines the MVRV ratio with the 1-year simple moving average, serves as a valuable tool for identifying macro market trends. When the MVRV ratio surpasses the simple moving average, it signifies a transition to a bull market. Conversely, a drop below the 1-year simple moving average signals a shift to the bearish phase.

The notable drop in the MVRV ratio below the simple moving average after Bitcoin’s price declined below $61,500 implies that a significant amount of BTC was purchased at a price above this level. With current holders facing a loss, there is a potential for substantial selling as investors aim to mitigate their losses.

This scenario could lead to an increase in selling pressure, potentially further depressing the price of Bitcoin. Consequently, declining prices may lead to a cycle of asset offloading, amplifying the momentum of the bearish phase.

Despite a recent 2.5% increase in Bitcoin’s price over the past 24 hours, hovering around $59,000, the cryptocurrency remains down by nearly 3% on a weekly basis. These indicators raise concerns regarding the potential impact of recent market developments on Bitcoin’s future performance.

In summary, the recent behavior of the MVRV ratio and its impact on the price of Bitcoin point to a potential shift into a bearish phase. Investors should closely monitor these developments and consider the implications for their investment strategies.

As the cryptocurrency market continues to evolve, it is essential to stay informed about the latest trends and indicators. By analyzing reputable sources and expert insights, investors can make well-informed decisions to navigate the dynamic landscape of digital assets.

Post Comment