Bitcoin’s Price Crossroads: What’s Next for the Crypto Market Leader

Bitcoin, the leading cryptocurrency, has garnered significant attention in the financial market due to its remarkable price performance in recent years. However, recent developments have indicated a potential shift in Bitcoin’s price trajectory, creating opportunities for investors to consider both buying and selling options.

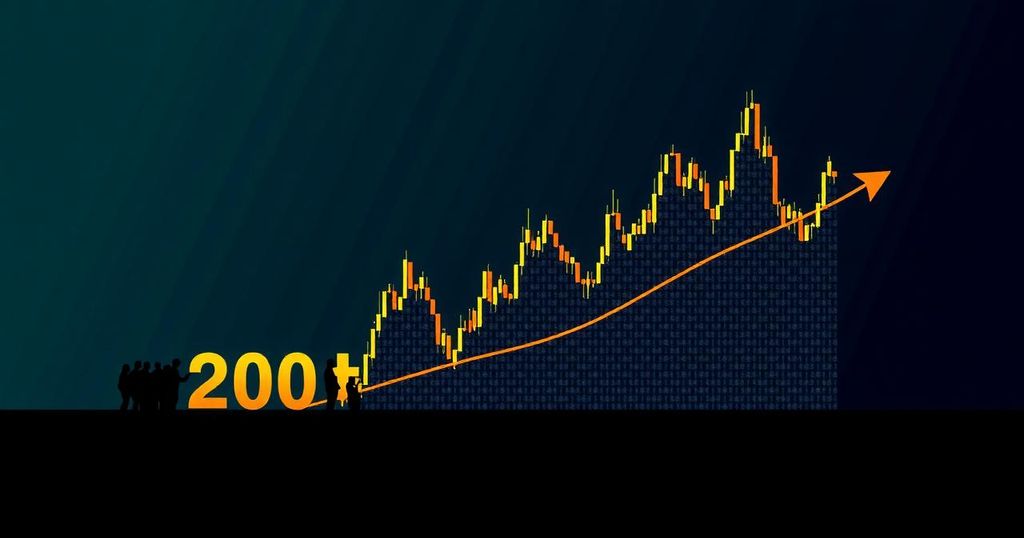

Renowned crypto analyst Ali Martinez has noted that Bitcoin’s price has dipped below its 200-day simple moving average (SMA), signaling a potential change in its price movement. The SMA is a commonly used tool to analyze price trends over a specific period, in this case, 200 days. Crossing above the SMA typically indicates an upward price movement, while falling below suggests a potential decline in price.

Martinez suggests that the current dip below the 200-day SMA may offer a buying opportunity for investors who believe in the long-term potential of the cryptocurrency. However, if Bitcoin continues to remain below the 200-day SMA for an extended period, Martinez predicts a possible bear market for the premier cryptocurrency.

At present, Bitcoin is trading at approximately $59,995 with a slight decline over the last seven days. Despite this negative performance, the overall sentiment in the community remains optimistic, with many investors believing in Bitcoin’s long-term profitability.

Much speculation surrounds the cryptocurrency, with many predicting that it could reach six-figure values in the near future. Factors such as historical price data, the potential introduction of a Bitcoin spot ETF market, and potential changes in U.S. government policy on digital assets contribute to the positive outlook for Bitcoin. However, in the short term, Bitcoin faces resistance levels at $62,000 and $70,000, presenting challenges for its price to surpass.

As the crypto market continues to evolve, Bitcoin’s price movements will be closely monitored by investors and analysts. Whether it maintains its bullish trend or experiences a shift towards a bear market, the future of Bitcoin remains uncertain. In the meantime, the crypto community eagerly awaits the next chapter in Bitcoin’s price story.

In conclusion, Bitcoin’s recent dip below its 200-day SMA has sparked discussions about its future price trajectory. Investors have options to consider and the overall sentiment towards Bitcoin remains positive. As the cryptocurrency continues to navigate the opportunities and challenges in the market, its price movements will be closely observed by all those with an interest in the crypto space.

Post Comment