The Impending 2024 Bitcoin Halving: What You Need to Know

The countdown to the Bitcoin halving event has commenced, and it is imperative for individuals with an interest in cryptocurrency to comprehend the significance of this occurrence. What precisely is the Bitcoin halving, and why does it hold such paramount importance in the realm of digital currencies?

Bitcoin Halving Explained

The Bitcoin halving takes place roughly every four years, resulting in a substantial reduction in the continual production of Bitcoin. This deliberate decrease in the creation of new Bitcoin is intended to safeguard the cryptocurrency from inflation while bolstering its value.

The Impact of Bitcoin Halving on Miners

With the occurrence of the Bitcoin halving, the quantity of new Bitcoin rewarded to miners for validating transactions is halved. This leads to a significant decrease in the availability of new Bitcoin, ultimately sparking a surge in demand for the cryptocurrency.

Total Bitcoin Supply and Mining

The maximum cap for the total supply of Bitcoin is fixed at 21 million, with the gradual distribution of newly created Bitcoins governed by a set of established regulations, one of which involves cutting the block reward in half every four years.

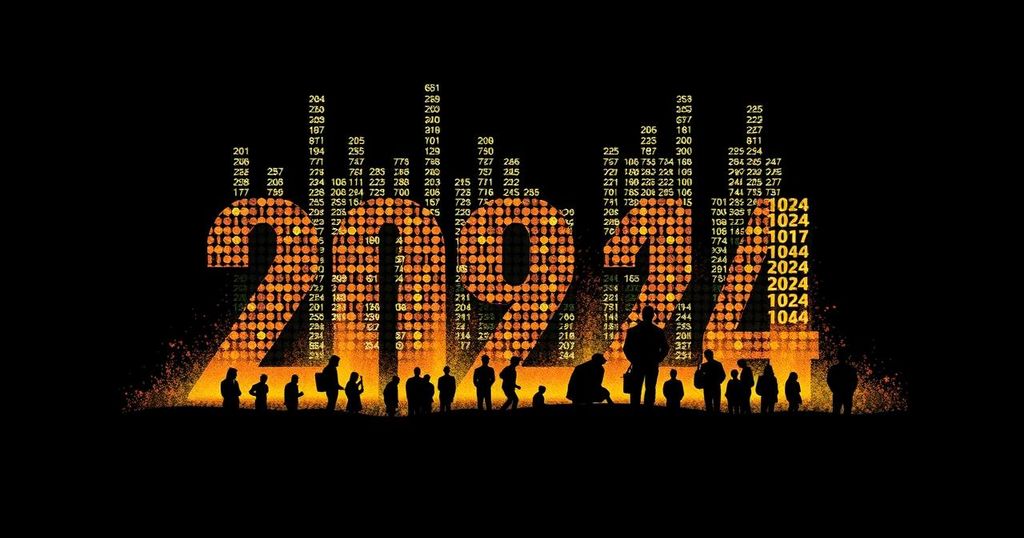

Countdown to Bitcoin Halving

Currently, there are two countdowns in place for the Bitcoin halving, offering estimations based on the average block time of 10 minutes and on-chain data directly from the Bitcoin blockchain. Both countdowns serve to provide a clearer understanding and approximation of the actual halving date.

The Future of Bitcoin Inflation

In 2024, the Bitcoin halving will reduce the block reward to 3.125 Bitcoins per block, effectively lowering the annual inflation rate to approximately 1.80%. This signifies that Bitcoin’s inflation may potentially be lower than the official inflation target set by central banks.

Historical Trends and Taking Advantage of Halving

Understanding historical price patterns following previous Bitcoin halvings can yield insights into potential future trends. Many investors employ a buy-and-hold strategy to capitalize on potential price surges post-halving, a method that has proven successful in previous halving cycles.

To Buy or Trade Bitcoin?

For those seeking to partake in the forthcoming Bitcoin halving, there are various options to consider, such as purchasing and retaining Bitcoin or utilizing trading platforms. It is crucial to thoroughly evaluate the available exchanges and select the one that best aligns with your requirements and preferences.

Overall, the Bitcoin halving presents a unique opportunity for cryptocurrency traders and enthusiasts. By comprehending the mechanics and ramifications of this event, investors can strategically position their portfolios for potential gains, as history has demonstrated.

Post Comment