Understanding India’s Bill on Cryptocurrency: What You Need to Know

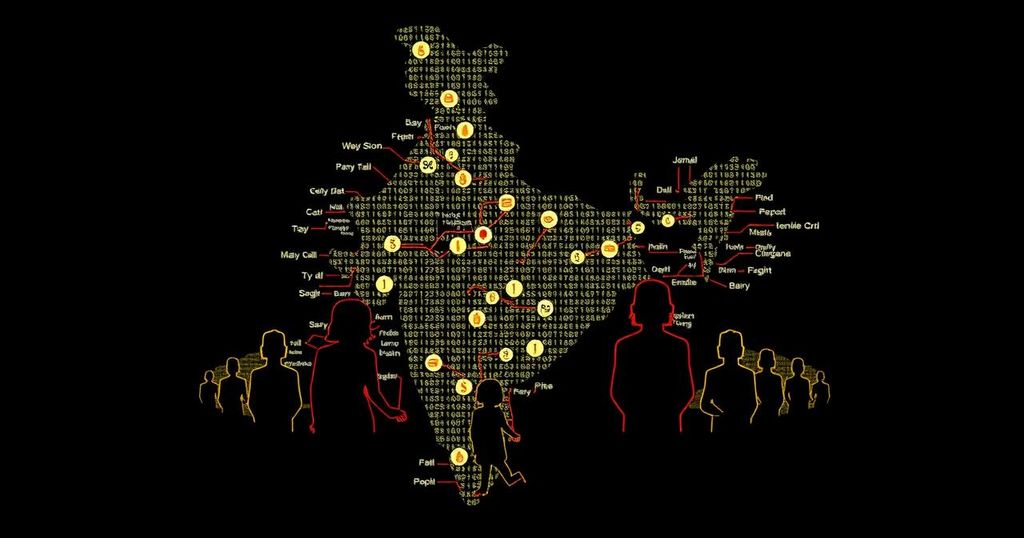

The realm of cryptocurrency has long been a subject of discourse and fascination. Due to its decentralized and borderless nature, the regulation of cryptocurrency has emerged as a significant concern for governments and financial authorities globally. In India, the introduction of the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 has prompted discussions and conjecture regarding the future of cryptocurrency in the nation.

This bill, designed to establish a favorable framework for the issuance of a digital currency by the Reserve Bank of India (RBI), has garnered much anticipation and interest. It aims to offer a structured approach to the regulation of cryptocurrency, non-fungible tokens (NFTs), decentralized applications, real estate tokens, and other virtual assets.

The Winter Session of the Parliament was initially slated to address the Cryptocurrency Bill, but it was deferred, leading to inquiries about its current status and the timeline for its introduction. In response, Shri Pankaj Chaudhary, Minister of State Finance, emphasized the necessity of international collaboration for effective legislation on cryptocurrency.

The legal status of cryptocurrency varies across different countries, with some embracing its potential while others imposing strict regulations or outright bans. In the United States, different states have varying laws concerning cryptocurrency, but overall, the nation maintains a positive approach towards the trading community and is considered a legal space for cryptocurrency.

Within the European Union, the majority of member countries have adopted a soft regulatory framework for cryptocurrency, and the European Commission has finalized a plan for legislation to regulate virtual assets. Similarly, the United Kingdom has permitted the use of cryptocurrency and updated its laws to regulate digital assets.

Conversely, nations such as China, Saudi Arabia, Pakistan, Bolivia, and Tunisia have imposed bans or severe restrictions on the use of cryptocurrency. The diverse regulatory landscape across different countries underscores the complexity and significance of regulating cryptocurrency on a global scale.

In the Indian context, the legal status of cryptocurrency remains uncertain, as there are no specific rules or guidelines for its usage as a payment medium. While the Finance Minister has proposed taxing digital assets, there has been no official clarification on the legality of cryptocurrencies in India.

The recent Union Budget of 2022 introduced a 30% tax on gains from cryptocurrencies and a 1% tax deduction at source, signaling the government’s intent to bring virtual assets under a taxation framework. However, the absence of a clear regulatory structure for cryptocurrencies raises concerns about the risks and uncertainties associated with investing in them.

The introduction of the Cryptocurrency Bill in 2021 and the ensuing taxation measures reflect the government’s efforts to navigate the complexities of regulating cryptocurrency in India. With the burgeoning cryptocurrency market witnessing significant growth, the need for a regulated and secure environment for investors and entrepreneurs becomes increasingly apparent.

Looking ahead, the road to regulating cryptocurrency in India is rife with challenges and opportunities. The government’s proposed legislation and taxation initiatives mark crucial milestones in the journey towards formalizing the cryptocurrency landscape. However, the task of creating a comprehensive and effective regulatory framework for cryptocurrency remains a complex and evolving endeavor.

As cryptocurrency continues to captivate the imagination of investors and technologists worldwide, the need for collaborative and informed regulation becomes ever more pressing. Balancing innovation with stability, and promoting responsible and secure practices within the cryptocurrency ecosystem are critical aspects of the ongoing discourse on cryptocurrency regulation.

In conclusion, the endeavor to establish a regulatory framework for cryptocurrency in India is multifaceted, demanding careful consideration and collaboration. From the legal status of cryptocurrency to the taxation of digital assets, the complexities and implications of regulating cryptocurrency in India present a dynamic landscape that calls for informed and proactive engagement.

As the dialogue on cryptocurrency regulation evolves, it is imperative to maintain a nuanced and inclusive approach that addresses the diverse perspectives and concerns surrounding this transformative phenomenon. The path ahead may be challenging, but with thoughtful and deliberate actions, the regulation of cryptocurrency in India can pave the way for a resilient and innovative digital economy.

Post Comment