Bitcoin Price Surges Alongside Asia’s Nikkei 225 to Reach $60.5K

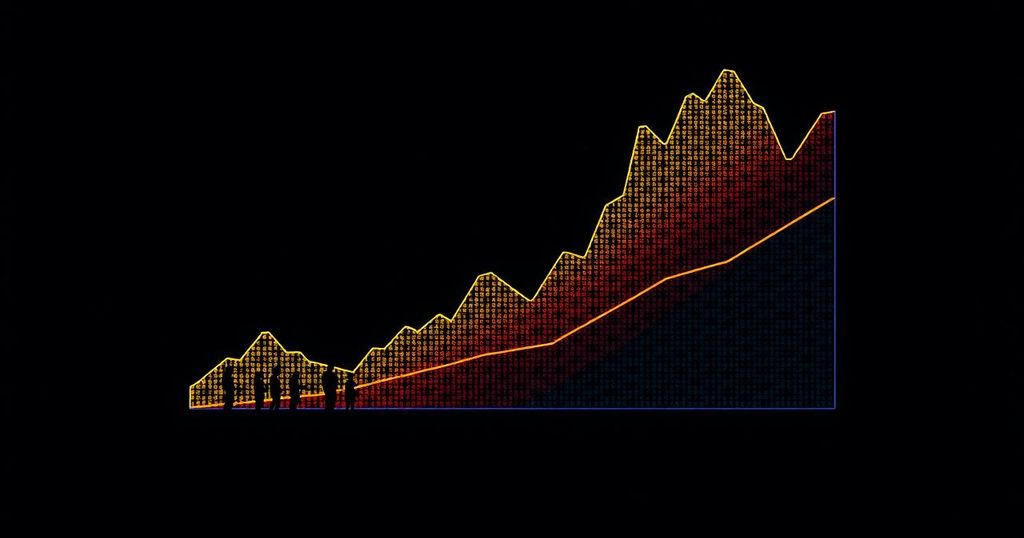

The price of Bitcoin (BTC) has witnessed a substantial increase, closely mirroring the positive performance of Asia’s Nikkei 225. Within the past 24 hours, the flagship cryptocurrency has observed a 3 percent upsurge, reaching a trading value of approximately $60.5k during the early Asian session on Tuesday. This upward trend has had a ripple effect throughout the entire crypto industry, with Binance Coin (BNB), Ripple-backed XRP, and Tron (TRX) leading the way.

The recent resurgence in Bitcoin price has alleviated concerns regarding potential further capitulation, resulting in heightened investor confidence. This is indicated by the uptick in Bitcoin’s fear and greed index from 28 percent to 30 percent, indicating a decrease in apprehension of additional crypto market downturns.

Notably, on-chain data analysis from Santiment has unveiled that Bitcoin addresses holding between 100 and 1k BTCs have amassed approximately 94.7k coins over the last six weeks. This specific group of Bitcoin whales now collectively possesses around 3.97 million BTC units. Among these whales is Metaplanet Inc., a publicly traded Japanese company, which recently acquired an additional 57.273 BTCs amounting to roughly $3.4 million, bringing their total Bitcoin holdings to about 360.368 BTCs.

Furthermore, another prominent investor procured a total of 347 Bitcoins valued at over $16 million from Binance within the past 24 hours. Additionally, US spot Bitcoin ETFs recorded a net cash inflow of approximately 2,139 coins, worth around $125 million on Monday, with Fidelity’s FBTC leading the way.

Looking ahead, esteemed crypto analyst Benjamin Cowen predicts that Bitcoin will continue to outperform the altcoin market in the near future, with expectations for the cryptocurrency’s dominance to rise to around 60 percent. Nonetheless, it is crucial to consider the technical aspect of Bitcoin’s current price movement. Despite the recent bullish surge, the flagship coin will need to consistently close above the 50 and 200 Moving Averages (MAs) to sustain its upward momentum. Failure to do so could result in Bitcoin retracing back below the $60k mark before making another push towards its all-time high.

For those interested in exploring additional investment opportunities, it may be worthwhile to consider certain altcoins that show potential for growth in the coming week.

In summary, Bitcoin’s recent price surge is attributed to its alignment with Asia’s Nikkei 225, indicative of improved market sentiment. With the heightened activity from Bitcoin whales and the overall positive outlook, there is anticipation for further positive developments in the cryptocurrency space.

Post Comment