Bitcoin’s Price on the Edge: Is $61,000 the Deciding Factor?

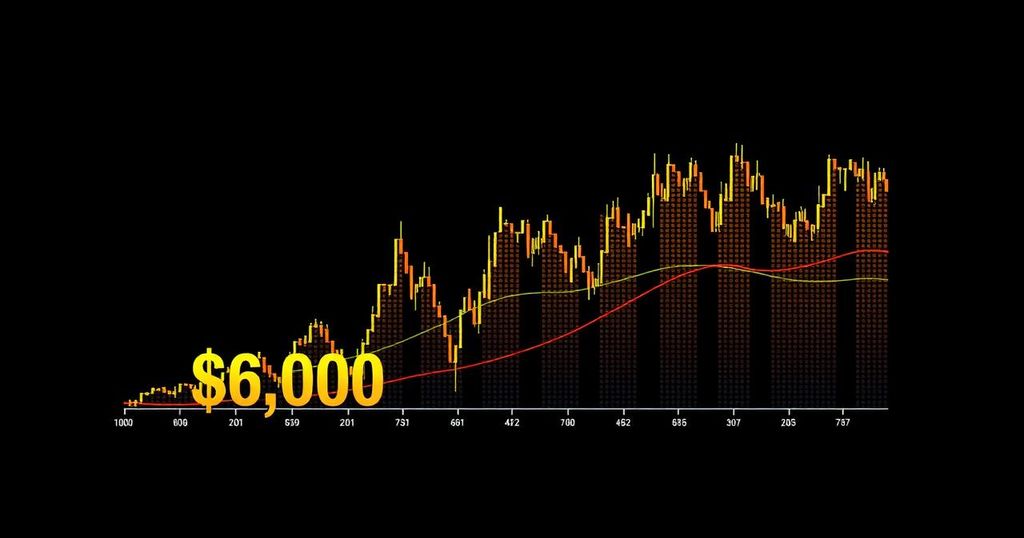

In recent weeks, Bitcoin’s price has exhibited significant volatility as it steadies near the pivotal threshold of $61,000. Initially showing strong upward momentum, the cryptocurrency’s ascent has encountered a series of hurdles that has left investors contemplating its ability to breach this critical barrier. The bullish expectations that once seemed imminent now appear precarious.

This article analyzes two potential trajectories for Bitcoin’s market performance: one characterized by a resurgence into bullish territory and the other suggesting a downturn if the current upward movement is merely a corrective phase. Utilizing Elliott Wave Theory, we will explore prospective price movements, identifying key support and resistance levels crucial to Bitcoin’s future.

Since August 5th, Bitcoin’s value has seen a steady climb, achieving a high of $62,400. However, following this peak, the price has subsequently experienced a mild retraction, indicative of either a minor wave correction within a developing five-wave uptrend or the onset of a new downward trend after completing a three-wave corrective phase upwards. On August 16th, Bitcoin approached a significant pivot point, with its price resting at approximately $57,600. This level was critical as it represented the last bastion for the continuance of the bullish trend.

Contrary to predictions of a bearish outcome, Bitcoin’s price rebounded from this support zone, reaffirming the potential for the bullish trend’s persistence. This rebound fundamentally shifted market sentiment from bearish to optimistic, setting the stage for prospective further increases. A decline beneath this threshold would likely have invalidated the feasibility of a five-wave uptrend, potentially driving prices downwards substantially. Conversely, with Bitcoin now sustaining levels above $57,600, the groundwork is laid for a potential escalation toward new highs.

On August 22nd, Bitcoin achieved a new high of $61,800, successfully breaking out of a previously established descending channel. Should a five-wave pattern emerge from the low established on August 5th, Bitcoin’s trajectory could rise toward $66,000. Should positive momentum persist beyond this level, there exists the possibility of reaching $70,000 in subsequent movements. However, it remains critical to note that if Bitcoin encounters significant resistance, a drop to $54,600 may ensue before any further advances toward the $70,000 target.

Moreover, it is essential to address the fact that Bitcoin has not exhibited a higher high since August 8th, suggesting that the prior upward wave, commencing from August 5th, could be interpreted as corrective in nature. In this scenario, the uptick from August 16th may rapidly conclude, leading to an increased momentum shift toward the downside.

Market indicators such as the Relative Strength Index (RSI) demonstrate a pattern of diminishing highs, which could signal a weakening momentum, while the Moving Average Convergence Divergence (MACD) indicates an impending bearish crossover. Should this bearish scenario materialize, Bitcoin may continue its descent, with immediate support anticipated at approximately $43,425. A more profound retracement could potentially push Bitcoin towards the significant 1.272 Fibonacci extension level, estimated to be around $38,149, representing a substantial decline from present valuations.

In conclusion, the bearish forecast posits that unless Bitcoin successfully navigates a breakout from the existing descending channel and reverses its current trajectory, it may continue to experience substantial selling pressure. The formation of lower lows and the anticipated conclusion of the corrective wave (C) suggest that Bitcoin could be positioned for a more extended downturn. Therefore, it is imperative for investors to closely monitor Bitcoin’s momentum and key support levels to gauge its future direction in this highly fluid market.

Post Comment