Fed Chair Jerome Powell Signals Policy Shift Ahead with Upcoming Rate Cut

In a recent keynote address at the Kansas City Federal Reserve’s Jackson Hole Symposium, Federal Reserve Chair Jerome Powell stated that the time has come for adjustments to monetary policy. According to Powell, the anticipated rate cut in September is a response to indications that inflation is on a sustainable path back to the targeted rate of 2 percent, coupled with a notable cooling in the labor market. He emphasized the importance of monitoring incoming data and evolving economic conditions as the Fed navigates this transition.

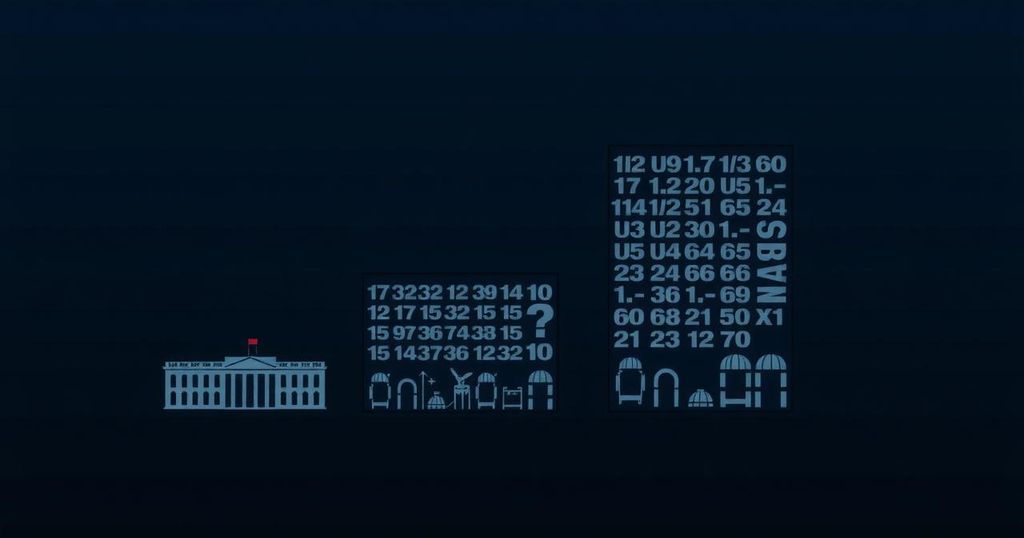

Following Powell’s remarks, market reactions were immediate and significant. Bitcoin experienced a notable increase, rising over 1% to approximately $61,900 shortly after the speech. Traditional financial markets also reflected a positive response, with the Nasdaq Composite Index showing a 1.7% uptick, the S&P 500 gaining 1.2%, and gold prices climbing by 1%. Additionally, the yield on the 10-year Treasury bond fell by five basis points to 3.80%, and the U.S. dollar index decreased by 0.6%.

The Federal Reserve had previously engaged in a series of rate hikes, lifting the federal funds rate to a range of 5.25% to 5.50% during 2023. As such, the announcement of a possible rate cut represents a significant shift in policy. The impending decision at the September Federal Open Market Committee meeting could see a 25 or 50 basis point reduction in rates, with current market analyses suggesting a greater probability of a 25 basis point cut, although the likelihood of a more substantial 50 basis point adjustment has risen to 32.5% from 24% in the previous day, according to CME FedWatch.

In conclusion, Chairman Powell’s statements at the Jackson Hole conference signal the Fed’s readiness to recalibrate its monetary policy in light of evolving economic conditions. Investors and market analysts alike will be closely attentive to the upcoming meeting, as the implications of the proposed rate adjustments could significantly impact both traditional financial markets and cryptocurrencies.

Post Comment