Federal Reserve Chair Powell’s Speech Sparks Cryptocurrency Market Rally

On August 23, 2024, Federal Reserve Chair Jerome Powell delivered a pivotal address in Kansas City, significantly influencing the cryptocurrency market. His remarks indicated a forthcoming adjustment in interest rates, igniting a robust rally across both the cryptocurrency and U.S. stock markets. Chairman Powell stated, “The time has come for policy to adjust,” suggesting that the Federal Reserve is leaning towards implementing interest rate cuts.

Powell’s comments further implied that the central bank may announce an interest rate reduction as early as September, although the magnitude of this cut will be contingent upon forthcoming economic data. The market is currently anticipating a substantial reduction of 50 basis points (0.50%) in September. Nevertheless, should the Federal Reserve opt for a more conservative 25 basis points (0.25%) cut, it could provoke a significant sell-off among investors.

In addition to discussing rate cuts, Powell expressed concern regarding the labor market, positing that it poses a greater risk to the economy than inflation at this juncture. He reassured that the Federal Reserve remains committed to fostering a robust labor market while striving for price stability.

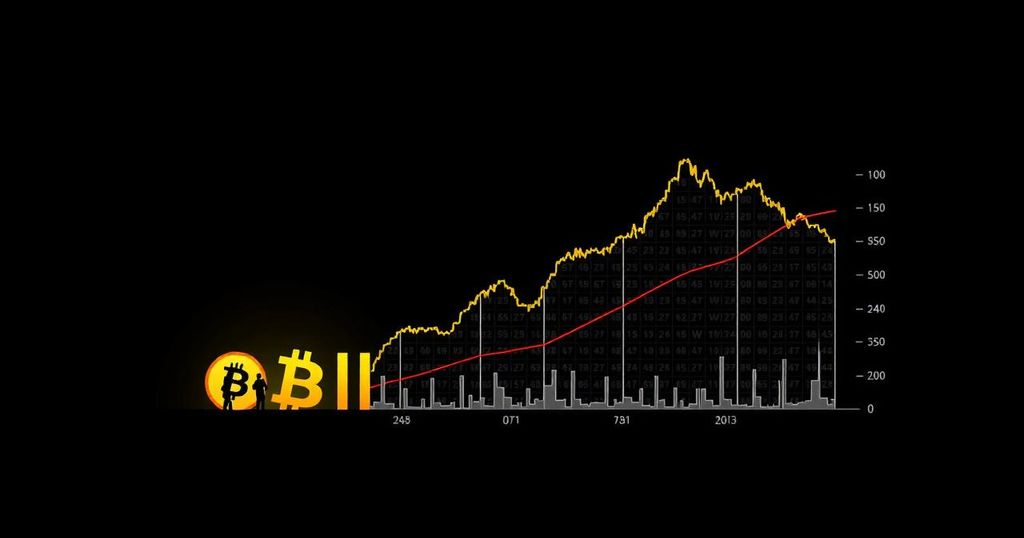

Commentary from financial analysts, including James Seyffart, highlighted that the market has yet to fully price in expectations for a 50 basis points reduction in September. In the wake of Powell’s discussion on rate cuts and labor market concerns, the overall cryptocurrency market experienced a notable increase of 0.61%. Key digital assets including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Dogecoin (DOGE) enjoyed price surges of over 2%, 3%, 1.5%, and 5%, respectively, within a few hours following the speech.

Specifically, Bitcoin is approaching a critical price threshold; should it manage to close a daily candle above the $62,200 mark, there exists a strong probability of its ascent to $68,000 or even $71,000 in the forthcoming days. In addition to Bitcoin’s performance, other cryptocurrencies such as Ripple’s XRP also appear poised for short-term volatility, indicating a dynamic trading environment ahead.

In conclusion, Powell’s words have not only catalyzed a surge in cryptocurrency valuations but also set the stage for potential monetary policy shifts that could reshape the economic landscape in the near future. Investors and market participants remain vigilant as they assess the implications of the Federal Reserve’s strategies toward interest rates and labor market conditions.

Post Comment