Bitcoin Surpasses $61,200 as Anticipation Grows for Fed Chair Jerome Powell’s Speech

On August 23, Bitcoin’s price maintained a position above $61,200 as market participants awaited a significant address from Federal Reserve Chair Jerome Powell at the upcoming Jackson Hole Economic Symposium. Earlier in the day, several Federal Reserve officials suggested a potential interest rate cut during the September meeting, advocating for a cautious and deliberate approach to monetary policy adjustments. Powell’s speech, slated for 7:30 PM IST, is generating considerable anticipation amongst traders, who seek favorable indications regarding prospective interest rate reductions.

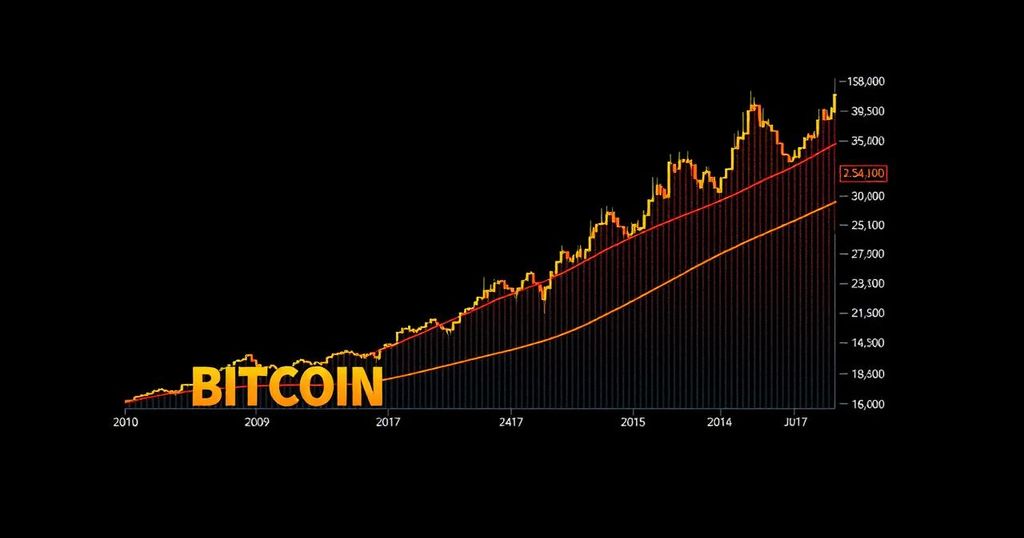

As of 2:43 PM IST, Bitcoin (BTC) experienced a modest increase of 0.55% over the preceding 24 hours, attaining a trading value of $61,254. Similarly, Ethereum (ETH) reflected positive movement, rising by 1.5% to trade at $2,671.

It is noteworthy that the overall capitalization of the cryptocurrency market appreciated by 1%, reaching approximately $2.17 trillion in the last 24 hours. Additional cryptocurrencies witnessed notable gains, as tokens such as Solana, Toncoin, Dogecoin, Cardano, Avalanche, Shiba Inu, Chainlink, Polygon, and Polkadot recorded increases of up to 11.5%.

Stablecoins exhibited considerable market activity, with their total volume now at $54.07 billion, representing 92.61% of the broader cryptocurrency market’s trading volume in the last 24 hours, as reported by CoinMarketCap. Within the same timeframe, Bitcoin’s market capitalization escalated to $1.21 trillion, positioning its dominance at 55.72%. However, it is essential to note that Bitcoin’s trading volume observed a decline of 26%, settling at $25.7 billion.

In conclusion, as cryptocurrency prices remain highly volatile, driven by macroeconomic factors and market sentiment, stakeholders must remain vigilant. The developments surrounding Federal Reserve announcements will undoubtedly play a critical role in shaping market dynamics in the immediate future.

Post Comment