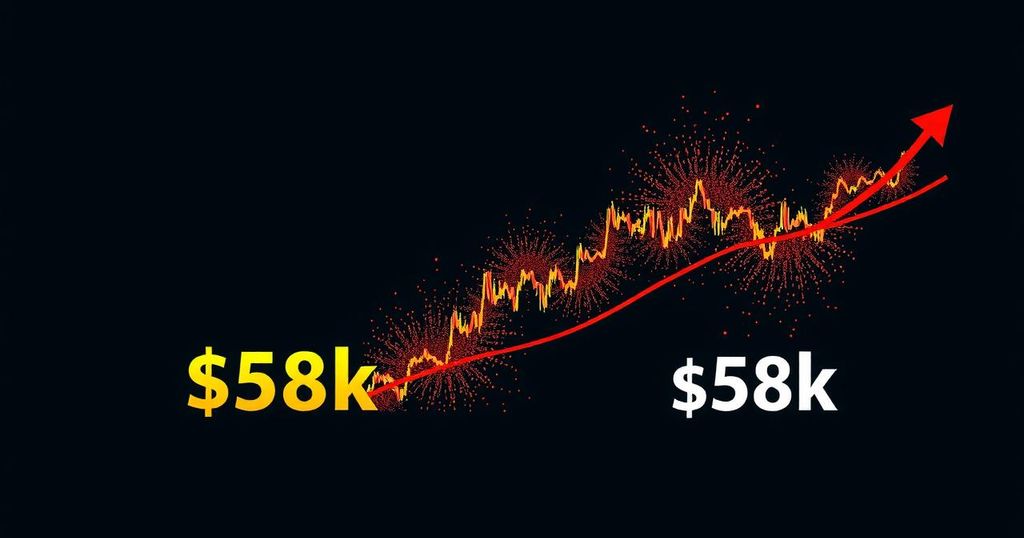

Bitcoin Faces Significant Price Decline to $58K, Causing Over $320 Million in Liquidations

In recent developments, Bitcoin has experienced a significant and troubling decline, witnessing a sharp decrease to a nine-day low of slightly over $58,000 within a mere 24-hour span. This abrupt drop has not only affected Bitcoin but has also led to substantial losses among various altcoins, such as Ethereum (ETH), Solana (SOL), Dogecoin (DOGE), Chainlink (LINK), Avalanche (AVAX), and Shiba Inu (SHIB). Collectively, the cryptocurrency market has faced liquidations surpassing $320 million.

Monday morning marked a moment where Bitcoin’s price attempted to stabilize around $65,000; however, it rapidly succumbed to selling pressure, dropping to $64,000 before a more stable period ensued on Tuesday. Nonetheless, the market dynamics shifted, culminating in a pronounced decline with Bitcoin falling to a reported price of $58,100 on Bitstamp, representing the lowest valuation since August 19.

As of the latest update, while Bitcoin has somewhat rebounded to a trading price of $59,500, it remains approximately 6% lower on the day, with its market capitalization diminishing from $1.240 trillion to $1.170 trillion. The altcoins have experienced even greater setbacks, with Ethereum decreasing by more than 8% and struggling to maintain a position above $2,500. Additional currencies such as SOL, DOGE, AVAX, SHIB, Bitcoin Cash (BCH), Polkadot (DOT), and LINK have recorded similar declines of up to 8%. Furthermore, select assets including MATIC, SUI, FET, TAO, and PEPE have suffered double-digit drops.

The overall cryptocurrency market capitalization has contracted, with over $100 billion evaporating daily due to this heightened volatility. This environment has proved detrimental to traders with substantial leverage, resulting in nearly 90,000 liquidations occurring within the past 24 hours. The total value of disrupted positions has surpassed $320 million, with the largest single liquidation order executed on Binance, amounting to over $12.5 million.

In conclusion, the recent plummet of Bitcoin’s value and the concurrent fallout affecting the broader cryptocurrency market underscore the inherent volatility and risks associated with investing in digital currencies. Investors and traders are therefore advised to exercise caution and conduct thorough analyses before engaging in trading activities, particularly in a fluctuating market landscape.

Post Comment