Bitcoin Faces Steep Decline Amid Negative On-Chain Sentiment and ETF Outflows

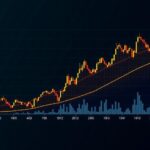

Bitcoin has experienced a notable decline as on-chain analysis indicates a prevailing negative sentiment in the market. As of Tuesday, the U.S. spot Bitcoin Exchange-Traded Funds (ETFs) encountered significant outflows amounting to $127.1 million, marking the first outflow in eight days. This shift in ETF dynamics coincided with Bitcoin’s price decline of 5.4% on Tuesday alone, following a broader market trend characterized by risk aversion. Currently, the combined reserves of the 11 U.S. spot Bitcoin ETFs are valued at approximately $46.73 billion, underlining the impact of investor sentiment on market stability.

In related developments, Nasdaq has initiated proceedings with the Securities and Exchange Commission (SEC) to list and trade Bitcoin Index Options (XBTX). This strategic move aims to facilitate better management of cryptocurrency investments for both institutional and retail investors. The options are intended to track Bitcoin prices leveraging the CME CF Bitcoin Real-Time Index, thereby enhancing market liquidity and maturity upon SEC approval.

Furthermore, recent on-chain data illustrates an increase in long liquidations alongside a higher ratio of short positions, thus reinforcing the bearish outlook. Notably, over 87,000 traders were liquidated, resulting in a total loss of $318.46 million, emphasizing the increased volatility and risk present in the current trading environment. A substantial liquidation amounting to $12.67 million was also recorded for a long position in ETH/BTC.

Moreover, the arrest of Telegram’s founder, Pavel Durov, by French authorities has engendered concerns within the cryptocurrency community. This incident has been interpreted as a potential catalyst for fear, uncertainty, and doubt (FUD) within the market, possibly contributing to the prevailing downward momentum of Bitcoin’s price. Influential figures in the cryptocurrency space, including Paolo Ardoino, CEO of Tether, and Elon Musk, have publicly voiced their concerns regarding the implications of Durov’s detention.

Technical analysis suggests that Bitcoin’s price is currently struggling below key resistance levels, having been rejected near $65,379. A slight recovery of approximately 1% was noted mid-week but lingering indicators such as the Relative Strength Index (RSI) and the Awesome Oscillator both sliding below their neutral levels imply enduring weakness and a likely continuation of the bearish trend. Should Bitcoin fail to maintain support above $58,783, further declines may lead to a retest of its daily support at $56,002.

In conclusion, while institutional efforts such as Nasdaq’s proposed Bitcoin Index Options signify forward movement towards integrating cryptocurrency within traditional finance, the prevailing market conditions, characterized by increasing short positions, significant ETF outflows, and regulatory scrutiny, suggest that Bitcoin’s challenges are far from over. Investors are therefore urged to monitor market developments closely and reassess their positions in light of this evolving landscape.

Post Comment