Understanding the Factors Behind Bitcoin’s Price Decline: Insights from CryptoQuant

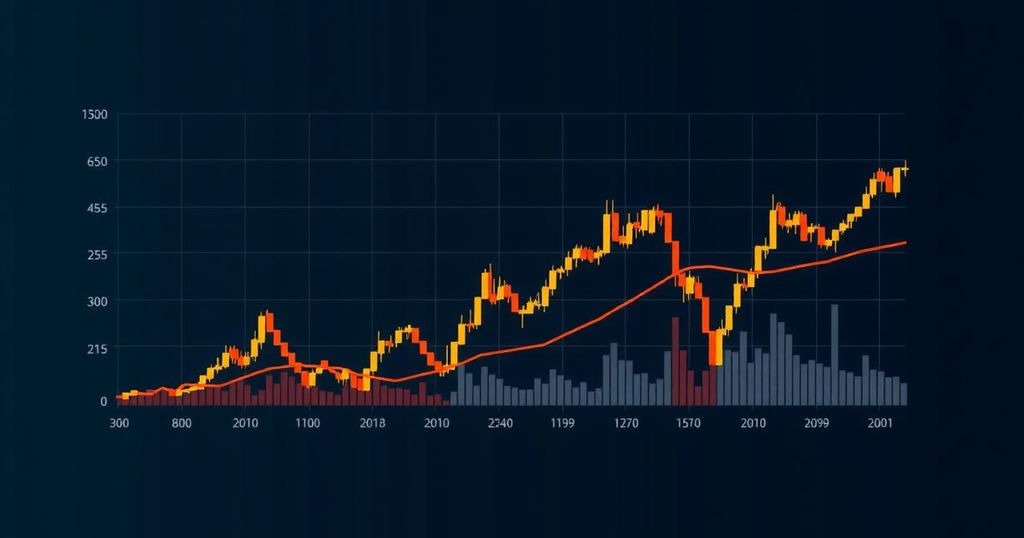

In recent weeks, Bitcoin (BTC) has faced significant challenges, particularly in its struggle to maintain the critical psychological threshold of $60,000. The on-chain data analytics group, CryptoQuant, has elucidated five pivotal charts that provide insight into the reasons behind this notable price decline. The current state of the cryptocurrency markets is rife with instability, prompting traders to grapple with ambiguous signals regarding the future trajectory of Bitcoin, as analysts remain divided over the likelihood of a market correction or a continued bullish pattern.

**Five Charts Dissecting the Bitcoin Price Decline**

Bitcoin has dipped below the significant $60,000 mark, which extends a retreat following a brief surge above $65,000. A detailed examination of key market fundamentals reveals compelling dynamics as traders and investors adapt to the prevailing market conditions.

One critical observation from CryptoQuant indicates that short-term holders of Bitcoin created a resistance barrier at their break-even price, suggesting they opted to take profits. The break-even price is defined as the point at which traders neither realize gains nor losses, aligning closely with their acquisition price of the asset. This strategic decision to cash in arose after a prior price downturn which had caused these short-term holders to face losses up to 17%. As the price rebounded to their average purchase price, these holders consequently liquidated their positions, contributing to the ongoing price decline.

**Increase in Open Interest and Positive Funding Rates**

CryptoQuant has also highlighted a notable rise in the premium of Bitcoin perpetual contracts, with total open interest experiencing a remarkable 31% increase since August 5, ascending from $13.5 billion to $17.9 billion. Open interest refers to the total number of open futures contracts, thereby offering insights into traders’ forecasts regarding forthcoming market movements. In a liquid market context, such heightened open interest is typically associated with improved execution prices, narrower bid-ask spreads, and minimized slippage, thus providing a more conducive environment for trading. This substantial increase is indicative of growing participation and interest in Bitcoin within the market.

Concurrently, positive funding rates have persisted, revealing that long position holders (buyers) have been compensating short position holders (sellers) to sustain their contracts. This scenario underscores a market environment where demand surpasses supply. The interplay of rising open interest alongside positive funding rates creates potential instability within traders’ positions, largely due to an escalation in speculative trading activity. As the market witnesses an influx of participants attempting to leverage opportunities amidst price fluctuations, volatility intensifies. Such dynamics often produce feedback loops, wherein increased market engagement exacerbates prevailing price movements, thereby complicating risk management efforts and market predictions.

**Surge in Spot Exchange Inflows**

Further exacerbating the situation is the uptick in Bitcoin inflows into spot exchanges during the recent price retraction, contributing to the notion of impending selling pressure. When investors transfer their Bitcoin assets to exchanges, it typically signifies an intention to sell, intensifying market strain on already delicate futures positions. CryptoQuant’s Head of Research, Julio Moreno, notes that these inflows are primarily associated with large holders, thereby amplifying market pressures.

Data illustrates that the surge in spot exchange inflows aligns closely with the observed price declines, reinforcing this perspective. An increased supply of Bitcoin available for sale on exchanges tends to enhance selling activity. When this supply overshoots the demand from potential buyers, it inevitably exerts downward pressure on the price, further fueling the decline.

**Exit of Weak Hands**

The culmination of these factors has prompted individuals with weaker positions to exit the market, resulting in heightened liquidation events. Notably, long positions in Bitcoin and Ethereum were liquidated for a total of $90 million and $55 million, respectively— the highest recorded levels of liquidation since early August, as per research conducted by CryptoQuant. The findings suggest that the market may require time to stabilize before a definitive directional bias becomes apparent. At present, Bitcoin’s trading value stands at approximately $59,118, reflecting a decline of nearly 5% since the commencement of the Wednesday session, according to data from BeInCrypto.

In conclusion, as these dynamics unfold within the cryptocurrency market, stakeholders are advised to remain vigilant, as the interplay of trading behaviors, market sentiment, and technical analyses will continue to shape Bitcoin’s price movements going forward.

Post Comment