Bitcoin Market Outlook: Navigating Volatility and Expectations

In recent hours, Bitcoin has exhibited unpredictable fluctuations while simultaneously indicating potential for recovery. This behavior mirrors broader trends among risk assets; as these assets experience gains, it is anticipated that Bitcoin will respond similarly.

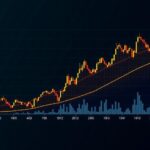

On Wednesday morning, the Bitcoin market experienced a minor pullback, only to subsequently demonstrate signs of renewed vitality. Observations suggest that the market continues to grapple with volatility, making it imperative to monitor the $57,500 threshold closely for indicators of future direction. Should Bitcoin surpass this level, there is potential for an ascent to the $59,000 mark, which has historically presented some resistance. Conversely, should the market decline below the lows established during Tuesday’s trading session, a descent to around $53,000 could ensue. Currently, Bitcoin appears somewhat ambiguous in its intentions, oscillating between bullish and bearish sentiments as it attempts to determine its identity in the market.

It is crucial to acknowledge the influence of the recently established Exchange-Traded Fund (ETF), which has led many investors to perceive Bitcoin more like an index that reflects overall risk appetite rather than as an isolated asset. In this evolving landscape, an increase in risk appetite among investors typically fuels Bitcoin’s ascent; conversely, a decline in the appetite has an adverse effect. Consequently, Bitcoin has become integrated into the global financial system, which suggests that its valuation will now align closely with the performance of other financial instruments. This integration is likely to dampen volatility, making dramatic price shifts—such as 15% increases within a day—less feasible.

While the market shows potential for a rebound, expectations should be moderated to reflect a more gradual increase rather than rapid gains. For an overview of today’s economic happenings that may impact the market, reference the economic calendar.

As one of FXEmpire’s analysts since the inception of the platform, I bring over two decades of expertise across diverse markets and asset classes, including currencies, indices, and commodities. My extensive experience encompasses both proprietary trading and the management of institutional accounts, which equips me with the insights involved in analyzing Bitcoin’s trajectory in the current financial climate.

Post Comment