Bitcoin Experiences Significant Price Decline Following Disappointing U.S. Jobs Report

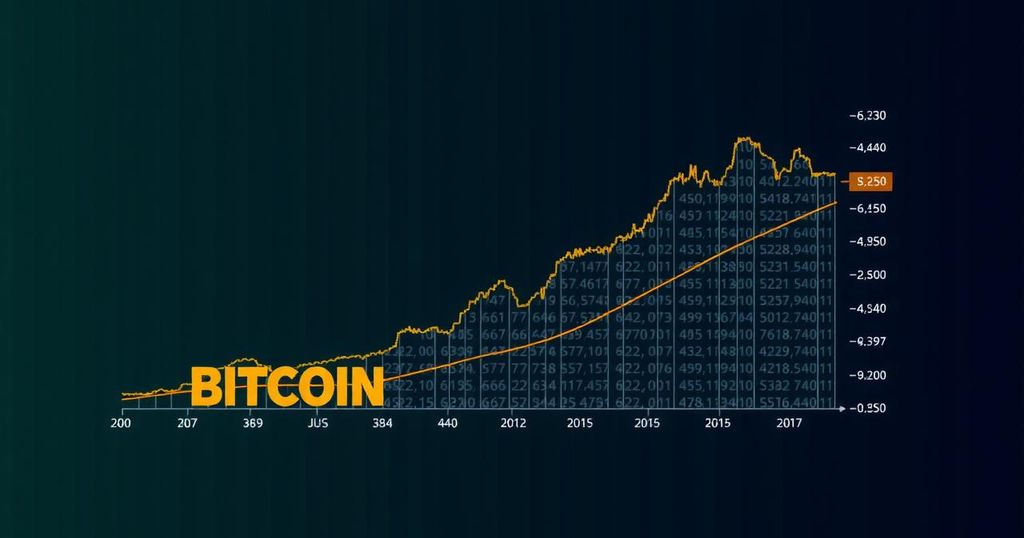

Bitcoin experienced a significant decline in its price, dropping to below $54,000 per coin on Friday, following the release of disappointing employment data from the United States. According to CoinGecko, the leading cryptocurrency is now priced at $53,829, representing a decline of nearly 5% over the past 24 hours and an overall decrease of 8% for the week, marking its lowest value since August 5.

The downturn in Bitcoin’s price is attributed to the Labor Department’s report indicating that the economy added only 142,000 jobs in the previous month, falling short of the anticipated 160,000 jobs. Although the unemployment rate showed a minor improvement, decreasing from 4.3% to 4.2%, the lackluster job growth has raised concerns regarding the robustness of the U.S. economy.

In reaction to the employment figures, investors exhibited a sell-off in other risk assets, notably causing a decline in technology stocks. The S&P 500 index recorded a drop of 1%, while the Nasdaq index fell nearly 2%. This trend highlights a growing correlation between cryptocurrency valuations and the performance of U.S. equities, as both markets respond sensitively to indications from the Federal Reserve concerning future interest rate policies.

Financial analysts speculate that the Federal Reserve may implement interest rate cuts this month, following a series of hikes that brought rates to a 22-year high in 2022. The degree and impact of these potential cuts remain uncertain.

In addition to Bitcoin, Ethereum, the second-largest cryptocurrency, has also suffered a decline, now trading at $2,282 after losing almost 4% in the past day. Similarly, other significant cryptocurrencies, including Dogecoin and XRP, sustained losses of approximately 5% and 4%, trading at $0.093 and $0.52 respectively. Overall, Bitcoin’s current valuation is almost 27% lower than its all-time high reached in March, which was $73,737, following the groundbreaking acceptance of spot exchange-traded funds (ETFs) that prompted an influx of investment into the cryptocurrency sector.

This market response underscores the sensitivity of cryptocurrencies to macroeconomic indicators, emphasizing the intricate relationship between fiscal policies, employment trends, and digital asset valuations.

Post Comment