Three Factors That May Influence a Bitcoin Price Recovery in September

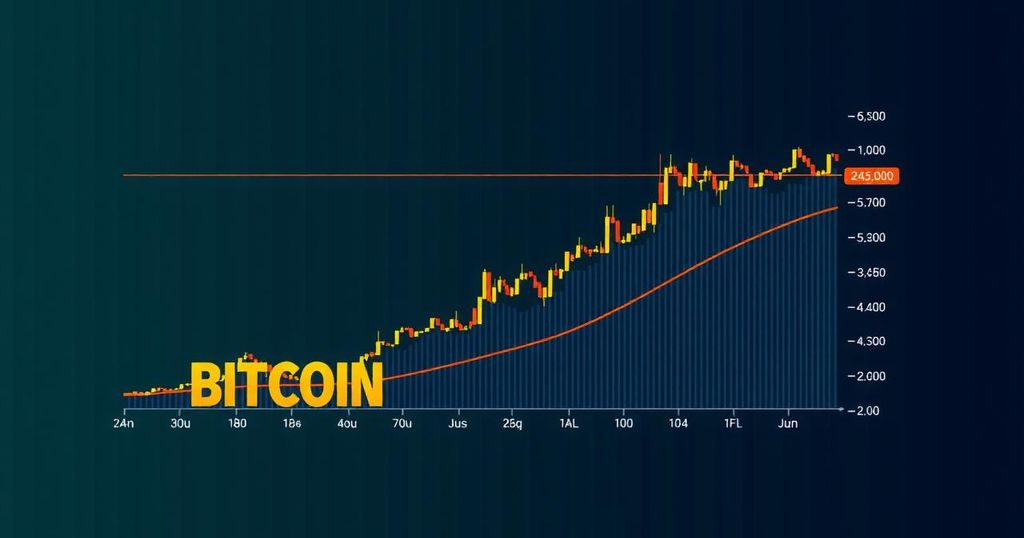

In recent weeks, Bitcoin (BTC) has experienced significant fluctuations, with its price oscillating between $55,000 and $65,000. A recent decline in value has raised concerns that September may be particularly challenging for bullish investors. Nevertheless, there are three notable factors that could indicate a potential rally for Bitcoin in the coming days.

First and foremost, a pivotal shift from the United States Federal Reserve may be on the horizon. Scheduled for September 18, the upcoming Federal Open Market Committee (FOMC) meeting is anticipated to yield a decision to lower interest rates. Such a move could facilitate cheaper borrowing, thereby enhancing the appeal of risk assets, including Bitcoin. Historical precedents reveal that Bitcoin experienced a significant surge at the end of August in response to comments from Chairman Jerome Powell regarding a prospective rate cut.

The second factor to consider is the recent activities of Bitcoin whales. According to reports from CryptoPotato, large-scale investors have been actively accumulating Bitcoin, even as prices have retreated. Individuals holding between 100 BTC and 1,000 BTC now collectively control over 20 percent of Bitcoin’s circulating supply, valued at an approximate $230 billion. Furthermore, the number of wallets containing 100 BTC or more has reached a 17-month peak of 16,120. This increased accumulation among large holders may constrain the available supply in the market, potentially leading to upward price movement, provided that demand remains stable. Additionally, the presence of more Bitcoin whales may inspire confidence among smaller investors, resulting in increased capital inflow into the market.

Lastly, observations regarding Bitcoin exchange netflow reveal a prevailing trend where outflows have outstripped inflows over the past week. Notably, significant outflows were recorded on September 3 and September 6, indicating a shift from centralized exchanges to self-custody practices. This development could be interpreted as a bullish signal, as it diminishes immediate selling pressure associated with centralized exchanges.

Conversely, there exists a bearish indicator that suggests the current correction in Bitcoin’s price may persist. Reports indicate a concerning trend among Bitcoin miners, who have sold over 2,600 BTC over a recent weekend, as stated by crypto analyst Ali Martinez. Miners represent a substantial segment of Bitcoin holders, and excessive selling could increase the circulating supply, thereby exerting downward pressure on price if demand fails to increase accordingly. Typically, miners divest their holdings to offset operational costs, such as electricity and maintenance of equipment. A sustained increase in selling activity may suggest that miners are contending with diminishing profit margins, signaling potentially adverse market conditions.

In conclusion, while there are several optimistic indicators suggesting a potential rebound for Bitcoin in September, the market remains fraught with challenges. The Federal Reserve’s expected rate cut, accumulating whale activity, and changing exchange dynamics present promising opportunities for investors. However, the selling pressure from miners may impose constraints on the price recovery. Investors should remain vigilant and informed, adapting strategies as market conditions evolve.

Post Comment