Bitcoin Poised for Potential Bullish Rebound Amid Declining Exchange Supply

Bitcoin (BTC) appears poised for a bullish resurgence, coinciding with a notable decrease in its supply on centralized exchanges. The premier cryptocurrency is endeavoring to maintain a support level around $57,000, notwithstanding ongoing apprehensions regarding potential price declines throughout September. As institutional investors exhibit renewed confidence, the groundwork may be laid for upward momentum in the approaching months.

In recent weeks, Bitcoin has shown signs of decelerating its downward trend, suggesting a shift towards more optimistic market sentiment. As of September 5, BTC is trading approximately at $56,760. This figure represents a drop from its all-time high exceeding $72,000; however, technical analysts are observing the potential formation of a bullish flag—a commonly recognized pattern that can precede a price breakout.

Historically, Bitcoin has demonstrated superior performance in the fourth quarter of the year. Analysts are attentively monitoring the market for indicators of a possible rally as 2024 draws to a close. Nonetheless, one must remain cautious; should Bitcoin continue to close near $54,000 over the forthcoming weeks, a further decline to a range of $48,000 to $50,000 could materialize.

A notable indicator of increasing faith in Bitcoin is the recent net inflow into Bitwise’s BITB, a well-regarded Bitcoin investment fund. On Wednesday, BITB reported net inflows exceeding $9 million, indicative of heightened interest from institutional investors. This influx may suggest that larger investors are positioning themselves in anticipation of Bitcoin’s recovery, thereby bolstering the likelihood of a bullish rebound.

Furthermore, outflows from U.S. spot Bitcoin Exchange-Traded Funds (ETFs) have diminished considerably. After enduring six consecutive days of significant outflows, the total plummeted from $287 million on Tuesday to a mere $37 million by Wednesday. This sharp decline implies an emerging market stabilization, as investors appear less willing to liquidate their Bitcoin holdings.

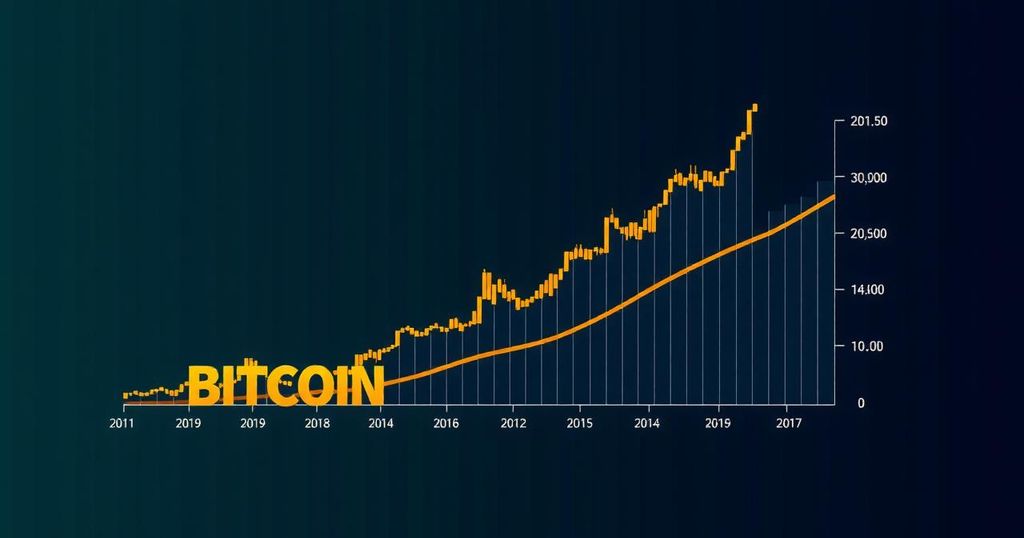

A critical element hinting at a potential price recovery is the decreasing supply of Bitcoin on centralized exchanges. Data from CoinGlass indicates that the available supply on these platforms has decreased from 2.68 million to 2.38 million over the past five months, suggesting a dwindling willingness among holders to sell, which could fuel a price rally.

This trend bears significance in light of historical patterns following Bitcoin’s halving events. Previous reductions in on-exchange supply have often led to substantial price rebounds, prompting many analysts to postulate that a similar situation could unfold.

Moreover, broader economic conditions are evolving in a manner conducive to Bitcoin and other high-risk assets. As Japan and Europe experience stabilizing economic circumstances, central banks are recalibrating their monetary policies. For instance, the Bank of Canada has recently enacted its third interest rate reduction since June, bringing the rate down to 4.25%.

Although such shifts in global monetary policy may provoke a temporary “sell-the-news” reaction in markets, many analysts contend that the long-term ramifications will be favorable for Bitcoin. Lower interest rates typically pave the way for increased investments in riskier assets, as investors pursue higher returns in a landscape where traditional savings instruments yield lower returns. In this context, Bitcoin may emerge as a compelling option for investors seeking to diversify their portfolios.

Bitcoin’s market dominance has seen an upward trajectory since the collapse of the FTX exchange in 2022. Nevertheless, growth in dominance has recently plateaued. The introduction of spot Ether ETFs in the United States and the launch of Solana ETFs in Brazil have awakened investor interest in altcoins, potentially setting the stage for a much-anticipated “alt season.”

Consequently, market analysts forecast a likely diminishment of Bitcoin’s dominance in the near term amid the rising interest in alternative cryptocurrencies. Yet, Bitcoin’s stature as the preeminent digital currency remains robust, and any forthcoming market rally is likely to feature Bitcoin as a primary contender.

Looking forward, Bitcoin’s pricing is anticipated to benefit from the concurrent decrease in exchange supply and evolving economic conditions. If institutional confidence continues to fortify and global monetary policy shifts toward favoring riskier assets, we may witness a pronounced rebound for Bitcoin in the latter quarter of 2024.

However, prudence is advised; while technical indicators may signal positivity, Bitcoin’s valuation could still encounter downward pressure should it fail to uphold critical support levels in the upcoming weeks. A potential decline into the $48,000 to $50,000 range remains a feasible outcome if current bearish momentum persists.

In summary, Bitcoin stands at a pivotal crossroads. With its supply on exchanges lessening and institutional trust on the rise, the prospects for a bullish rebound appear increasingly favorable. Nonetheless, the inherently volatile nature of the cryptocurrency market necessitates that investors remain vigilant and prepared for potential fluctuations as the year advances.

Post Comment