Evaluating Ethereum’s Price Potential in September: Challenges and Opportunities

In anticipation of potential market fluctuations, analysts examine four potential scenarios for Ethereum’s (ETH) price performance in September, considering its ability to overcome significant price obstacles.

The recent implementation of the Dencun upgrade, which introduced cost-effective blob transactions for Layer-2 blockchains, aims to enhance the scalability of the Ethereum network. This upgrade has catalyzed increased activity within Ethereum’s decentralized smart contract ecosystem. Notably, there has been a marked reduction in gas fees on Ethereum’s base layer, subsequently boosting usage on low-fee Layer-2 solutions, despite a corresponding decline in validator revenues. Evidence indicates that the number of monthly active users on Ethereum’s Layer-2 networks has doubled since the upgrade’s inception in March, accompanied by substantial reductions in fees across various platforms, such as Base, Mantra, Starknet, Blast, and Optimism Mainnet.

However, Ethereum has struggled to capitalize on these enhancements, with its market performance lagging behind that of Bitcoin. Following a recent drop to $2,400, Ethereum’s price has reverted to early February levels, while Bitcoin has exhibited relatively better performance throughout the year. This raises questions regarding Ethereum’s competitiveness against other cryptocurrencies, including BNB, Solana, XRP, Tron, and Cardano.

Despite the aforementioned challenges, several factors suggest favorable outcomes for Ethereum in 2024:

1. Increased Use of Wrapped Bitcoin: The recent introduction of additional Wrapped Bitcoin assets on the Ethereum blockchain underscores Ethereum’s utility and robust product offerings. This creates a compelling case for holders of Bitcoin seeking flexibility across diverse applications within Ethereum’s ecosystem.

2. Growing Institutional Adoption: Ethereum’s institutional appeal persists, despite a cautious approach to Ethereum ETFs. Major corporations and financial institutions, such as Coinbase and Sony, continue to explore and adopt Ethereum-based products, signaling confidence in Ethereum’s future.

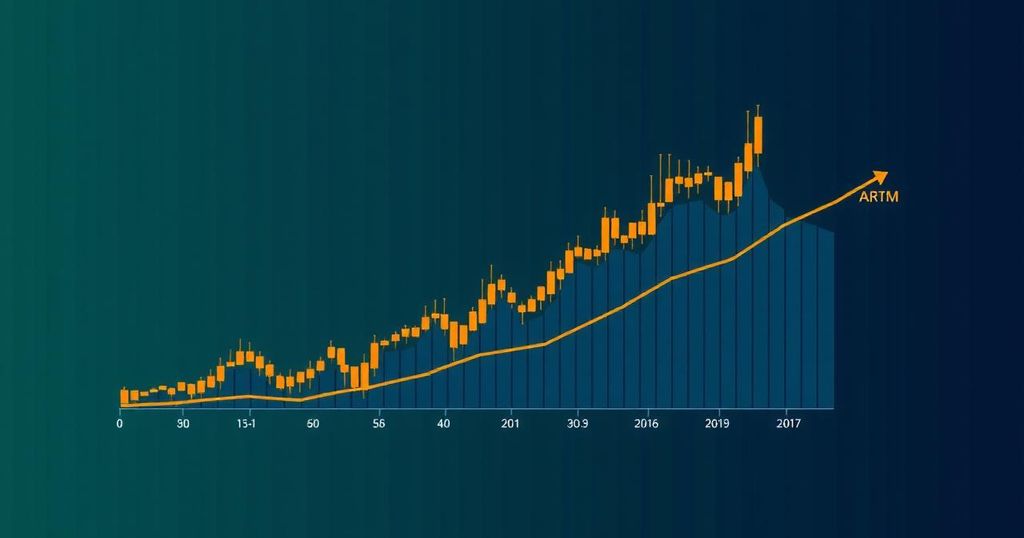

3. Positive Price Chart Dynamics: After experiencing significant losses in August—its worst month in two years—sale-like conditions could present a buying opportunity, potentially leading to a price rebound based on historical mean reversion principles.

4. Supportive Macro-Financial Conditions: The shift towards lower interest rates by the Federal Reserve may invigorate the cryptocurrency market. Increased liquidity and a tendency among investors to hedge against dollar inflation using limited-supply assets like Ethereum suggest a supportive environment for future price appreciation.

Nevertheless, Ethereum faces three critical price hurdles in September:

1. Seasonal Market Trends: Historically, September tends to be a challenging month for financial assets, including cryptocurrencies. Acknowledging this trend may position investors to strategically capitalize on perceived discounts.

2. Political and Economic Uncertainty: The upcoming U.S. election introduces unpredictability into market dynamics. Speculations regarding potential outcomes may influence investor sentiment and market performance.

3. Bitcoin Price Correlation: Ethereum’s market performance is closely tied to Bitcoin’s price movements. The cyclical nature of Bitcoin’s market behavior suggests that an anticipated bear period may adversely impact altcoin values, including Ethereum.

In conclusion, while Ethereum faces significant challenges that could hinder its price growth in September, its underlying advantages provide a foundation for optimism regarding its future trajectory. Strategic observations of market conditions will be essential for investors navigating this evolving landscape.

Post Comment