Michael Saylor Issues Cautionary Advice Amid Bitcoin Price Decline

In light of the recent decline in Bitcoin’s value, Michael Saylor, the co-founder and executive chairman of MicroStrategy, has articulated a warning that has garnered significant attention within the cryptocurrency community. Through a recent tweet, Mr. Saylor emphatically stated, “You do not sell your Bitcoin.”

This assertion arrives at a crucial moment when many investors may be inclined to liquidate their assets, especially as the Crypto Fear and Greed Index indicates that the market is currently experiencing extreme fear. Such conditions could lead to panic selling, driven by apprehensions and uncertainties, resulting in hasty decisions regarding asset liquidation.

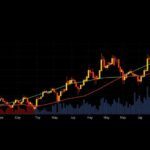

Following a brief surge in cryptocurrency values after the release of the U.S. jobs data, the market has reverted to volatility, leading to Bitcoin’s (BTC) valuation plummeting to its lowest point in a month. After an initial rally that propelled Bitcoin above $57,000, the price abruptly fell below $54,000, marking a significant drop since August 5.

In the early trading hours on Saturday, Bitcoin witnessed a decline of 3%, settling at approximately $54,360. Other notable cryptocurrencies such as Ethereum, Dogecoin, and Pepe similarly exhibited losses nearing 4%. This price fluctuation resulted in substantial liquidations on crypto derivatives markets, amounting to nearly $292 million within a 24-hour period, as reported by CoinGlass, predominantly affecting leveraged traders who were optimistic about further price increases.

Analysts are evaluating the factors influencing Bitcoin’s performance, with Julio Moreno, Head of Research at CryptoQuant, suggesting that the token’s underwhelming activity stems from a stagnation in demand growth. Moreno observed that current valuation metrics indicate a bearish trend, noting, “Indeed, demand is declining right now.”

Meanwhile, Ki Young Ju, CEO of CryptoQuant, pointed out that Bitcoin’s spot trading volume on Coinbase has reverted to pre-spot ETF levels. For a bullish market cycle to persist, there is a necessity for a rebound in U.S. demand, which Ju anticipates may occur in the fourth quarter, albeit with the caveat of uncertainty.

Furthermore, crypto analyst Ali Martinez highlighted a concerning statistic regarding the Accumulation Trend Score, which is nearing 0. This suggests that market participants are either distributing their investments or refraining from accumulating Bitcoin at this juncture.

In conclusion, the current market dynamics necessitate cautious consideration from cryptocurrency investors. Michael Saylor’s staunch advice against selling Bitcoin during periods of fear underscores the importance of maintaining a long-term perspective amidst short-term volatility. As analysts continue to glean insights into market trends, the onus remains on investors to conduct thorough research and seek professional counsel before making any financial decisions.

Post Comment