Bitcoin’s Profitability Decline and Low Liquidity Raise Concerns Among Investors

Bitcoin is currently experiencing a downturn, as it faces significant selling pressure. Despite a positive outlook at the beginning of August, market conditions have shifted negatively, resulting in a persistent decline. The daily chart indicates that the momentum of the uptrend is dissipating, and the price has settled towards the lower end of its recent consolidation range. Immediate support is identified between $56,500 and $58,000, reflecting the lows observed in July and August respectively.

Furthermore, a notable decline in profitability among Bitcoin holders has been reported, with approximately 25% of BTC now held at a loss. According to an on-chain analyst, this translates to nearly 5 million BTC under unfavorable circumstances, alarmingly far exceeding the holdings of Bitcoin’s pseudonymous creator, Satoshi Nakamoto. The data suggests a possibility that these loss-making coins are predominantly owned by short-term holders (STHs), who typically acquired their assets within the last 155 days. This category of investors is generally more prone to sell during price declines, which may exacerbate the current market slump.

Conversely, should the majority of these assets be in the hands of long-term holders (LTHs)—those who have retained their investments for over six months—this group, often composed of institutional investors and staunch HODLers, may provide some stability against further declines. If LTHs maintain their positions, it could potentially support a rebound, allowing for a price target of $66,000 or higher.

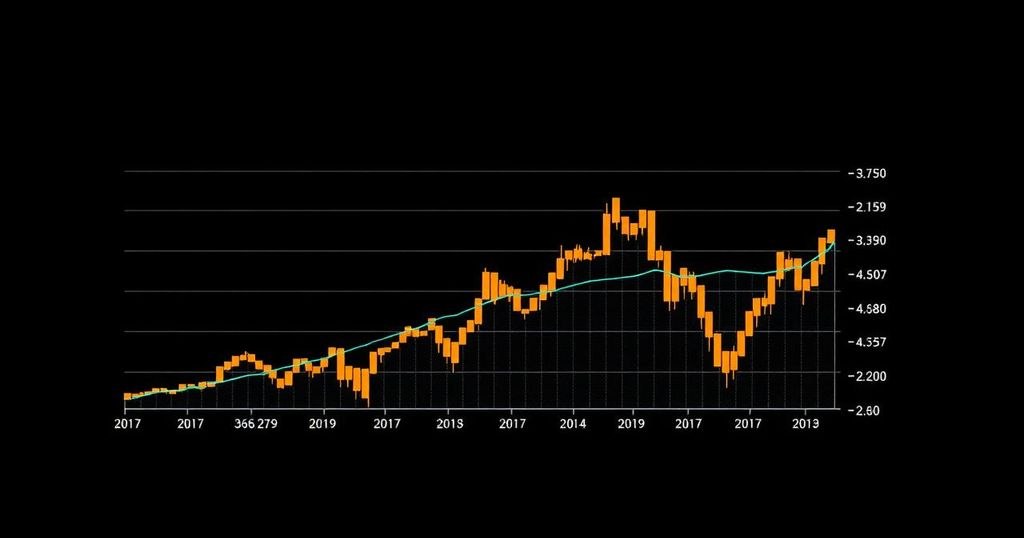

In addition to the shrinking number of profitable holders, Bitcoin’s liquidity conditions have also deteriorated. The Exchange Liquidity Ratio has fallen to notably low levels, remaining beneath the 365-day moving average. Analysts point out that this situation reflects a general caution among traders, leading many to adopt a sideline stance. During periods of declining prices, one can typically expect an increase in market volatility; however, as liquidity drips further, the short-to-medium-term outlook remains bleak due to minimized trading activity.

Compounding these liquidity concerns is a significant decline in active addresses on the Bitcoin network, reaching the lowest levels observed since 2024. This drop in address activity is indicative of waning investor interest, suggesting a concerning trend in market engagement.

In conclusion, the combination of a decreasing number of profitable Bitcoin holders and declining market liquidity signifies a challenging environment for Bitcoin investors. As the potential for further price declines persists, careful observation of market developments will be essential for stakeholders navigating these turbulent conditions.

Post Comment