Bitcoin Price Outlook: Potential for Gains Amidst Key Resistance Levels

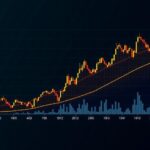

Bitcoin has shown a promising uptrend, surpassing the crucial resistance level of $55,500. Currently, it is consolidating, with the potential to extend gains should it break through the $58,000 resistance.

After establishing a support base near $52,500, Bitcoin’s price is now trading decisively above $55,500, buoyed by the 100-hourly Simple Moving Average. An important development occurred as the price broke above a bearish trend line that had resistance at $55,300 on the hourly chart of the BTC/USD pairing.

The ongoing upward momentum allowed Bitcoin to spike above the $58,000 resistance zone, reaching a peak at $58,050, although it has since consolidated, dipping slightly below $57,500. This recent pullback saw the price retreat below the 23.6% Fibonacci retracement level of the surge from $52,569 to $58,050.

Bitcoin remains above the pivotal $55,500 threshold and the aforementioned 100-hourly moving average. Looking ahead, any upward movement may encounter resistance at the $57,500 level, with significant resistance awaiting near $58,000. A decisive breach of this level could trigger further price increases, potentially motivating Bitcoin to test the $58,500 mark, which, if surpassed, might pave the way for a rally towards $60,000.

Conversely, if Bitcoin fails to overcome the $58,000 resistance zone, it may initiate a corrective decline. Immediate support is situated around the $56,750 level, followed by the major support at $55,500, corresponding with the 50% Fibonacci level of the preceding upward move. Should the downtrend continue, the price may approach the $53,500 area, with further losses risking a drop to approximately $52,600.

Technical indicators suggest a nuanced market. The hourly MACD indicates a slowing momentum in the bullish zone, while the Relative Strength Index (RSI) remains above the midpoint, suggesting a continued interest among buyers.

The major support levels include $56,750 and $55,500, while key resistance levels are found at $57,500 and $58,000. The current market behavior illustrates a delicate balance where bullish sentiment may continue to drive Bitcoin’s price above significant resistance levels, or a failure to achieve this may prompt reversals toward lower support zones.

In conclusion, as the market navigates these pivotal thresholds, investors may need to exercise caution and engage in comprehensive technical analysis to ascertain potential market movements in the near future.

Post Comment