Bitcoin Price Retreats Following Mixed Economic Data Amid Rate Cut Anticipations

Summary

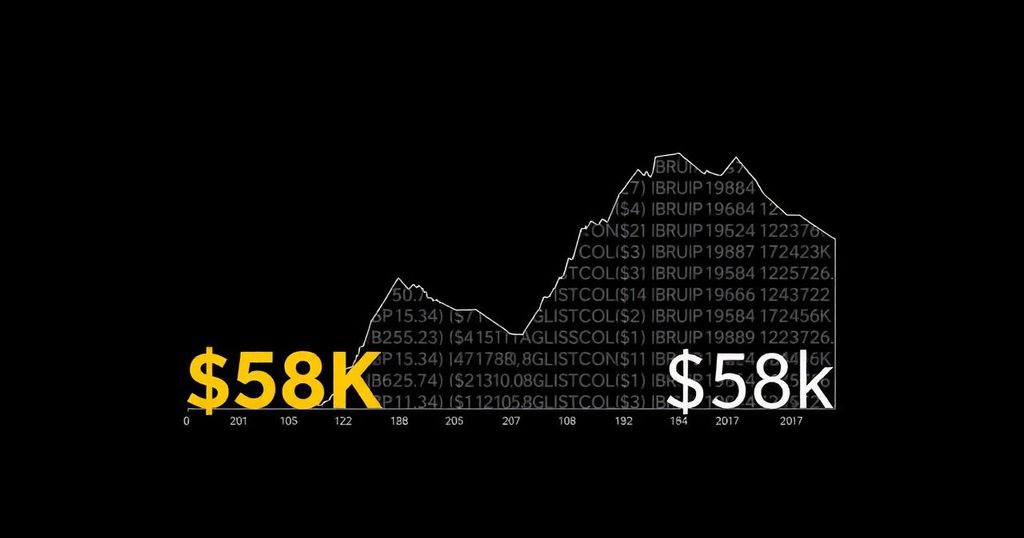

Bitcoin’s price has fallen below $58,000 despite marginal gains for the day. Economic data indicated a higher-than-expected month-on-month PPI increase, while jobless claims were also above projections. Analysts foresee a likely interest rate cut by the Federal Reserve, which may impact Bitcoin positively, yet market sentiment remains cautious due to overhead resistance around $60,000.

The price of Bitcoin has experienced a decline from $58,000, although it remains modestly higher for the day. Recent data reveals a 0.3% month-on-month increase in the U.S. Producer Price Index (PPI) for August, slightly surpassing expectations. In contrast, the year-on-year PPI came in at 2.4%, which was lower than anticipated. The Kobeissi Letter observed a similar trend in Consumer Price Index (CPI) inflation, noting that annual and monthly figures present diverging narratives. Additionally, the labor market data showed initial jobless claims at 230,750, exceeding the projected 227,000, leading some analysts to speculate on the Federal Reserve’s upcoming monetary policy decisions. Despite the mixed economic indicators, Kobeissi anticipates the Federal Reserve will implement a modest interest rate cut of 0.25% during its meeting scheduled for September 18. The CME Group’s FedWatch Tool corroborates this outlook, with market participants pricing in an 85% probability for such a cut. Trade analyst Michaël van de Poppe commented that while the European Central Bank (ECB) has preemptively reduced rates, the U.S. data reflect a complex economic landscape, even with lower-than-expected PPI figures suggesting potentially favorable conditions for Bitcoin. Currently, Bitcoin appears to be at a crossroads, seeking direction after a tumultuous trading session in the U.S. markets. Following an initial drop in price, BTC/USD managed to mirror the upward trend of technology stocks, ending the day above $57,300. Notably, trader Skew remarked on the persistent overhead resistance near the $60,000 mark, suggesting that the market sentiment may not be overly optimistic amid these pressures. Furthermore, Bitcoin statistician Willy Woo referenced his proprietary indicators to signal indecisiveness in the market moving forward, highlighting the need for stronger buyer conviction to push price increases.

This article discusses the recent fluctuations in Bitcoin’s price in light of economic data releases from the United States, particularly focusing on the Producer Price Index (PPI) and jobless claims. Such economic indicators significantly influence market sentiment and, ultimately, the performance of cryptocurrencies. The increasing scrutiny of monetary policy, especially in relation to interest rate changes by the Federal Reserve, plays a crucial role in shaping traders’ strategies and expectations for Bitcoin’s price.

In summary, Bitcoin has dipped below the $58,000 threshold amidst mixed economic signals from the United States that reflect inflationary trends and labor market dynamics. While the Federal Reserve is expected to consider a rate cut to stimulate economic activity, current market sentiment remains cautious due to persistent resistance levels. It appears critical for Bitcoin to attract strong buying interest to overcome these barriers and gain upward momentum.

Original Source: cointelegraph.com

Post Comment