Anticipated Fed Rate Cut and Its Impact on Bitcoin Volatility

Summary

The upcoming interest rate cut from the U.S. Federal Reserve is likely to induce volatility in the bitcoin market, following a recent price decline. While many expect a 25 basis point cut, speculation about a more substantial 50 basis point reduction raises concerns about economic stability, potentially leading investors to retreat from risky assets like bitcoin, despite its longstanding appeal as a hedge against currency depreciation. The overall economic backdrop, compounded by labor market vulnerabilities and shifting global conditions, amplifies this uncertainty, making investors brace for a bumpy September.

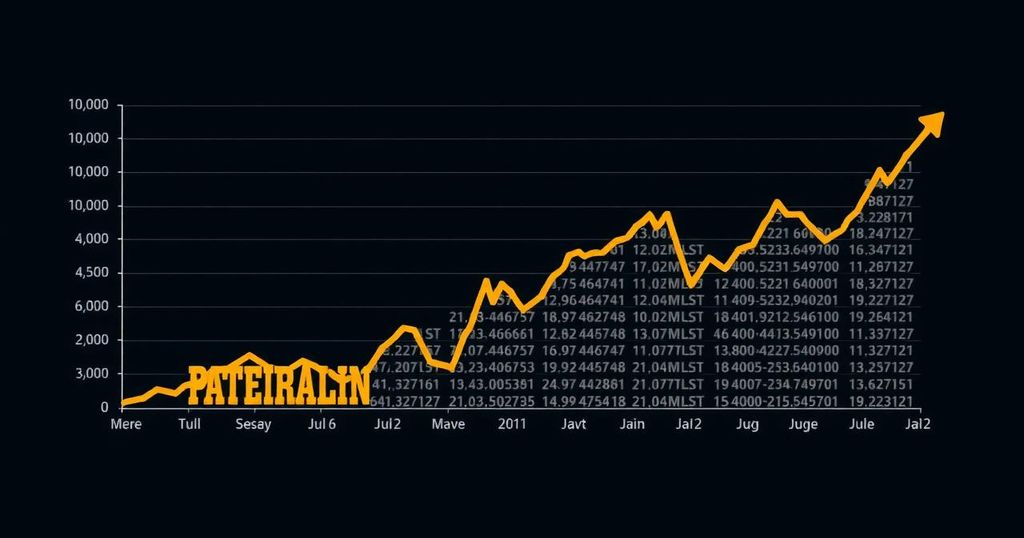

The cryptocurrency market is preparing for heightened volatility in September due to the anticipated interest rate cut from the U.S. Federal Reserve. Following a notable drop from approximately $65,000 in August to around $59,000 in early September, bitcoin’s trajectory is subject to fluctuations influenced by the Fed’s forthcoming decision. Market participants largely expect a 25 basis point (bps) reduction, yet there is speculation regarding a more significant 50 bps cut that could escalate volatility further. This tension arises amidst a broader backdrop of economic instability resulting from questionable central bank policies, contributing to uncertainty among those who consider bitcoin as a safeguard against currency devaluation. Historically, rate cuts have typically been perceived as bullish for bitcoin since easing monetary policy tends to diminish the value of the U.S. dollar and enhance demand for alternative assets like bitcoin. Nevertheless, this prospective rate reduction may yield contradictory effects. After an aggressive tightening phase in 2022 aimed at combating inflation, the Fed’s shift to more accommodative policies may not align with the expectations of stability among market participants. A rate cut could raise anxieties surrounding a potential economic downturn, prompting investors to shy away from perceived riskier assets like bitcoin, even as its fundamental value remains unchanged. Concerns regarding a 50 bps cut stem from the context of deteriorating macroeconomic indicators. The rapid rate hikes implemented in the previous year exposed vulnerabilities in the economy, and recent labor market reports reflect ongoing weaknesses. In light of consistently revised job data, it becomes increasingly apparent that the U.S. labor market is experiencing substantial strain, which could factor into decisions regarding economic policy. Globally, weakening economic conditions in various jurisdictions, including challenges faced by the European Central Bank and the Bank of Japan, are contributing to shifting liquidity dynamics. Concurrently, China is injecting liquidity to prop up its faltering economy, further complicating international market conditions. The impending U.S. presidential election may also present additional uncertainty as it brings forth proposals that could adversely affect investment climates and economic growth. Bitcoin’s relationship with prevailing economic conditions has proven to be complex and unpredictable. At times, bitcoin acts as a refuge during volatile periods, such as geopolitical tensions, while at others, it may serve as a risk appetite indicator, as seen during the COVID-19 pandemic. Overall, while central banks attempt to stabilize economies through liquidity injections, they inadvertently emphasize the enduring value of bitcoin as a decentralized monetary alternative. Over time, the intrinsic monetary characteristics of bitcoin are likely to prevail. As the month unfolds, bitcoin investors must prepare for potentially significant shifts in value. While a 25 bps reduction may have limited immediate repercussions, a more pronounced 50 bps cut could spark significant market reactions. The true test for the Federal Reserve will be its ability to navigate economic risks while retaining market confidence; success may bolster bitcoin, whereas worsening recession fears could lead to further declines, forcing investors to contend with an increasingly volatile and unpredictable landscape.

The article examines the implications of an anticipated interest rate cut by the U.S. Federal Reserve on bitcoin’s volatility. The narrative begins with a recent decline in bitcoin prices and sets the stage for understanding the interplay between monetary policy and cryptocurrency markets. It highlights the common perception of rate cuts as favorable for bitcoin, juxtaposed with the potential for economic deterioration influencing investor sentiment. The broader macroeconomic environment, including the labor market’s struggles and international central banking challenges, paints a picture of the financial landscape in which bitcoin operates, thereby accentuating its dual role as both a risky asset and a hedge against currency devaluation.

In conclusion, the evolving financial landscape marked by the Federal Reserve’s imminent interest rate decision stands to significantly impact bitcoin’s volatility. Anticipated rate cuts may traditionally bolster demand for bitcoin; however, a more aggressive approach could invoke fears of deeper economic instability. Investors are advised to remain vigilant as the juxtaposition of potential rewards and risks could create a tumultuous environment for bitcoin in the near future. The coming weeks will test the resilience and adaptability of bitcoin as an alternative financial asset amidst uncertain economic conditions.

Original Source: www.forbes.com

Post Comment