Bitcoin (BTC) Price Analysis: Are We Witnessing the Bottom? When Will the Bull Market Commence?

Summary

Bitcoin has recently crossed the $58,000 mark, showcasing bullish potential amidst ongoing volatility. While there is optimism for a move towards $59,000, analysts warn of possible bearish movements if resistance levels are not maintained. Key support zones are highlighted at $55,000 and $52,500, adding to the caution regarding future price actions.

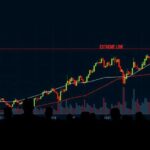

Bitcoin (BTC) is showing signs of renewed momentum following a price breakthrough beyond $58,000, approaching a crucial resistance point. While this uptick may signal the potential for a significant bullish movement, analysts caution that increased bearish activity could emerge if Bitcoin cannot maintain its position above these gains. Presently, the cryptocurrency market exhibits pronounced volatility, with Bitcoin experiencing balanced pressure from both buyers and sellers. The recent performance has enabled the bulls to avert substantial losses by pushing the price above $58,000, yet bearish participants remain cautious following these developments. The price progression is critical as any rise must solidify above significant resistance levels to avoid further declines. Bitcoin has been in a descending parallel channel since the beginning of the year, and analysts predict a move could potentially elevate prices above existing ranges. The rising Relative Strength Index (RSI) supports the assertion of a target near $59,000. However, this advancement may take additional time, especially as Bitcoin strives to secure crucial resistance points. Michael van de Poppe highlights on the aforementioned chart two key support zones at approximately $55,000 and $52,500, emphasizing that without intervening events, Bitcoin could experience a price drop. Historical sell-offs have tightened liquidity around the $56,000 mark, rendering those support zones favorable to bears, thus a test of these areas could lead to further declines. In light of these observations, the expectation is for Bitcoin’s price to retest the lower support zone, which may instigate a vigorous rebound. However, the fundamental bullish momentum may only truly commence once Bitcoin successfully closes its daily trades above $58,300, signaling a shift towards prolonged bullish activity.

The topic of Bitcoin price fluctuation is crucial for investors and analysts alike as it influences market sentiment and trading strategies. As Bitcoin approaches critical price levels, understanding resistance and support zones is essential. The discussion surrounding whether Bitcoin has yet reached its price bottom is vital, particularly in light of ongoing volatility within the cryptocurrency market. Current assessments indicate that the market is at a pivotal crossroads, with significant implications for future price movements based on upcoming trading actions.

In summary, Bitcoin’s recent price activities reflect both potential and volatility, suggesting that while the bulls are making strides above $58,000, the possibility of bearish corrections remains. Analysts underscore the importance of closing trades above $58,300 to confirm sustained upward momentum. Observing the support zones at $55,000 and $52,500 will be key in determining Bitcoin’s short-term trajectory, which may lead to significant price actions moving forward.

Original Source: coinpedia.org

Post Comment