Key Bitcoin Price Levels Amid Jobs Report and Fed Decision

Summary

The imminent U.S. jobs report and the Federal Reserve’s interest rate decision are poised to significantly impact Bitcoin’s price movements. Key price levels to watch include $20,000 as support and $25,000 as resistance, while rising institutional interest and macroeconomic factors also play critical roles in the cryptocurrency’s future trajectory.

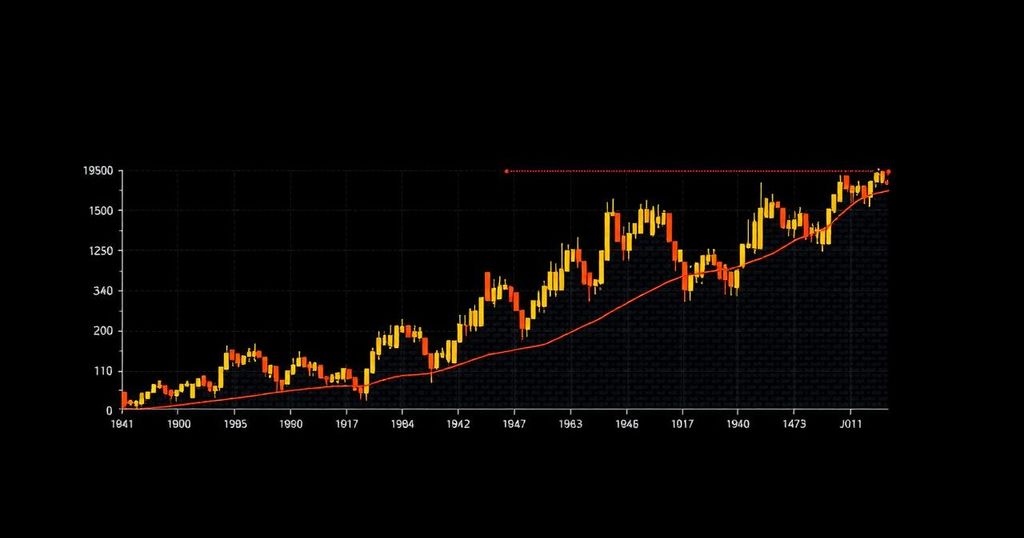

As the financial landscape prepares for the imminent U.S. jobs report and the Federal Reserve’s interest rate resolution, Bitcoin (BTC) traders are meticulously observing several essential price levels. These forthcoming events are anticipated to greatly affect Bitcoin’s trajectory, possibly inciting increased volatility within the cryptocurrency market. The upcoming jobs report, set for release shortly, aims to elucidate the status of the U.S. labor market. An encouraging report could bolster the U.S. dollar, exuding downward pressure on Bitcoin prices. In contrast, a report that falls short of expectations might devalue the dollar, thereby potentially allowing Bitcoin to ascend. Additionally, the Federal Reserve’s imminent decision regarding interest rates presents another critical element. Should the Fed adopt a hawkish positioning, it may fortify the dollar, imposing weight on Bitcoin. Conversely, a dovish inclination could favor Bitcoin by undermining the dollar and enhancing risk assets. Currently, Bitcoin’s technical arrangement indicates that traders are fixating on several crucial levels. On the downside, the $20,000 threshold serves as a significant support level—any breach beneath this point could incite a seller avalanche, further lowering prices. On the upside, the $25,000 price point operates as a notable resistance, and surmounting this level might signify the commencement of a new bullish trend for Bitcoin. Market sentiment remains a vital factor as well. Recent evidence suggests that institutional investors are expressing heightened interest in Bitcoin, signaling a potentially stabilizing influence on Bitcoin prices during tumultuous market periods. Moreover, the overall macroeconomic conditions persist as influential determinants for Bitcoin’s price direction. Factors such as inflationary trends, geopolitical complexities, and regulatory changes continue to shape the price landscape. Investors are diligently scrutinizing these variables as they navigate the prevailing uncertainties.

In recent economic discussions, two pivotal factors are drawing considerable attention from the financial sector: the U.S. jobs report and the Federal Reserve’s decisions regarding interest rates. Both events are expected to hold significant sway over the behavior of Bitcoin and, by extension, the cryptocurrency market. The jobs report provides insights into the labor market’s health, which ties directly into economic indicators and, consequently, currency valuations. Similarly, the Federal Reserve’s stances—either tightening or loosening monetary policy—directly affect the strength of the U.S. dollar and the attractiveness of risk assets like Bitcoin. Furthermore, the increasing interest from institutional investors in Bitcoin signifies a maturing market that is becoming more reactive to such economic indicators. Understanding these elements is crucial for investors and traders seeking to navigate the volatile nature of cryptocurrency markets.

In summary, the impending U.S. jobs report and the Federal Reserve’s interest rate decision are critical catalysts poised to influence Bitcoin’s price dynamics. Traders and investors must remain vigilant regarding significant support and resistance levels, as well as the overarching market sentiment and macroeconomic conditions, in order to strategically navigate the complexities of this volatile market. Such diligence will be essential for making informed decisions as these influential economic events unfold.

Original Source: cryptocurrencynews.com

Post Comment