Bitcoin (BTC) Price Defies Historical Trends and Exhibits Bullish Momentum for September

Summary

Bitcoin (BTC) has reclaimed the $60,000 mark, rising by 3.51% in one day and 10.54% over the past week, amidst a volatile market that has seen a total trading volume of $67.04 billion. The market leader is experiencing increased ETF inflows, with positive momentum suggesting potential price targets of $62,000 and $66,000, barring any significant bearish reversals.

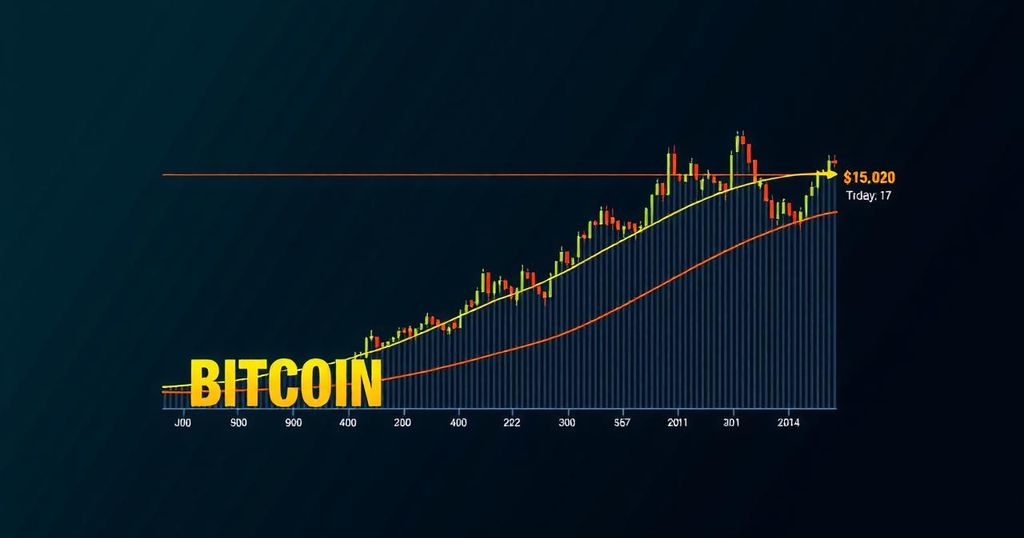

Currently, Bitcoin (BTC) has demonstrated remarkable resilience, as evidenced by its recent price movements amidst increasing market volatility. The global cryptocurrency market capitalization has exceeded $2.10 trillion with a 3.09% increase observed within the last 24 hours, alongside an impressive trading volume of $67.04 billion. Bouncing back to surpass the $60,000 threshold, Bitcoin’s price has rekindled optimism surrounding the potential to reach $100,000 within the current year. Bitcoin’s price surged by 3.51% in just one day, reaching a high of $60,656.72, and reflects a significant increase of 10.54% over the past week, resulting in a year-to-date (YTD) return of 41.96%. The chart featuring the Simple Moving Average (SMA) exhibits a bullish trend, suggesting heightened buying activity for the leading cryptocurrency. Furthermore, the Relative Strength Index (RSI) has shown an upward trajectory above the halfway mark within the 1-Day timeframe, reinforcing positive sentiment supported by the average trendline. Regarding Bitcoin Exchange-Traded Funds (ETFs), the past 24 hours have witnessed a substantial influx of positive flows in 7 out of 11 BTC ETFs. Fidelity led the charge with an impressive flow of $102.1 million, followed closely by Ark with $99.3 million. Additionally, Bitwise, Grayscale, Franklin, VanEck, and Valkyrie have seen increases of $43.1 million, $6.7 million, $5.2 million, $5.1 million, and $1.7 million, respectively, culminating in an overall flow of $263.2 million, all of which indicate enthusiastic bullish momentum for Bitcoin. Looking forward, if Bitcoin maintains its price above the $60,000 support level, bullish investors are likely to target $62,000. A sustained performance at this level could pave the way for a potential rise to the $66,000 resistance level by month-end. Conversely, a downturn could revisit the support level of $58,000, and if bearish trends accelerate, a decline towards the lower support of $55,000 may occur.

Bitcoin has consistently captured the attention of investors and analysts alike due to its volatility and potential for significant returns. In recent weeks, Bitcoin’s price movements have mirrored broader market trends, including fluctuations in trading volume and global market capitalization. The relationship between Bitcoin ETF flows and its price has become increasingly pronounced as institutional interest in cryptocurrency continues to grow. The forthcoming weeks are crucial for Bitcoin, primarily as market participants assess whether it can sustain its upward trajectory or whether corrections will ensue.

In summary, Bitcoin’s current resurgence above the $60,000 level ignites renewed hope for achieving substantial price milestones, including the coveted $100,000 mark for the current year. A favorable market environment that maintains support above $60,000 may witness Bitcoin inching towards higher resistance levels. However, vigilance is warranted as market dynamics can exert downward pressure, potentially reversing gains and testing lower support levels. Investors will keenly monitor these developments to gauge market sentiment and make informed decisions.

Original Source: coinpedia.org

Post Comment