Bitcoin Reclaims $60K as Institutional Interest Grows: Analysts Weigh In

Summary

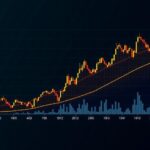

Bitcoin has reclaimed the $60,000 level amidst increasing institutional investor interest, differing from the predominantly retail-driven market of 2021. Analyst Rajat Soni emphasizes that the current environment may lead to a new price dynamic, as institutional buyers are prepared to absorb sales from retail investors. Bitcoin is currently trading at $60,596, with expectations for a potentially positive close in September, which has historically been a weak month for the asset.

Bitcoin has successfully reclaimed the significant $60,000 price threshold for the first time since August 30. This resurgence is attributed to rising interest from institutional investors, suggesting a departure from previous trends, according to crypto analyst Rajat Soni. In a post made on September 13, Soni asserted, “This time is different,” highlighting that prior to this moment, the last time Bitcoin exceeded $50,000 was in 2021, a period characterized predominantly by retail investor activity. He elaborated that during that time, Bitcoin struggled to maintain values above $50,000, largely due to retail investors’ emotional trading behavior. Soni further indicated that institutional investors are now an intrinsic part of the market, ready to buy any assets that retail investors decide to sell, advising his followers that if they are selling now, they may face significantly higher costs to repurchase later. As of the latest data from CoinMarketCap, Bitcoin is trading at $60,596, reflecting an increase of 4.25% since September 12. In light of Bitcoin’s recent surpassing of the $60,000 mark, pseudonymous trader Jelle speculated that Bitcoin may break its typical underperformance trend in September, remarking that the asset is currently on pace to close the month positively—a rare achievement, having only closed in the green three times in previous Septembers (2015, 2016, and 2023). It is noteworthy that historical data from CoinGlass illustrates September as a challenging month for Bitcoin, with an average monthly loss of 4.49% over the past 11 years. Concurrently, Into The Cryptoverse founder Benjamin Cowen referenced the highest daily close in Bitcoin market dominance recorded throughout the current cycle, with market dominance at 57.80% as per TradingView. Furthermore, Will Clemente, a co-founder of Reflexivity Research, remarked on September 13 that early technical indicators hint at a potential recovery for Bitcoin, with an aim to reclaim its 200-day moving average, which would correspond with achieving its first higher high in six months.

The cryptocurrency market is characterized by its volatility and rapid changes, with Bitcoin, being the first and most widely recognized cryptocurrency, often serving as a bellwether for the entire market. The $60,000 price level holds psychological significance among traders and investors, marking a critical point in trading activity. Prior to this recent recovery, Bitcoin had only seen values above $50,000 influenced heavily by retail investors whose buying and selling decisions are often swayed by emotional responses rather than analytical assessments. The entry of institutional investors is seen as a stabilizing and potential driving force behind price increases. Given that historical data illustrates that September is generally a poor month for Bitcoin, analysts are closely observing market movements to determine if this trend will persist or if this time indeed differs due to changing dynamics.

In summary, Bitcoin’s reclamation of the $60,000 price threshold marks a potential turning point influenced by the growing participation of institutional investors, contrasting the previous reliance on retail speculation seen in 2021. Analysts are hopeful that the current market conditions may lead to positive September performance, historically uncommon for the asset. This trend invites a broader discussion regarding the evolving investor landscape and the implications of institutional involvement in cryptocurrency markets.

Original Source: cointelegraph.com

Post Comment