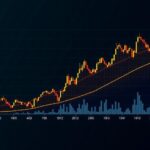

Bitcoin Price Analysis: Is BTC Heading Toward $65K After a Weekly Surge of 10%?

Summary

Bitcoin has witnessed a significant bullish reversal, surging nearly 15% from critical Fibonacci support levels, currently approaching a major resistance at the 100-day moving average near $61.6K. As it nears the $65K resistance zone, market sentiment remains cautious, with potential consolidation anticipated if selling pressure increases. The MVRV ratio suggests a possible long-term recovery but emphasizes the importance of a patient approach due to current market volatility.

Bitcoin has demonstrated a robust bullish reversal from a significant support zone identified by the 0.5 and 0.618 Fibonacci levels. Presently, BTC is approaching the 100-day moving average at approximately $61.6K, where it is likely to face notable selling pressure, hinting at a potential short-term consolidation phase. Technical Analysis Upon thorough analysis of Bitcoin’s daily chart, it is evident that after descending into the key support zone, consistently ranging between the Fibonacci levels of 0.5 ($56.3K) and 0.618 ($52.1K), the asset experienced substantial buying pressure which catalyzed a sharp bullish reversal. This upward momentum has culminated in an approximate 15% price increase toward the major resistance level of the 100-day moving average at $61.6K. The prevailing price action signifies a re-entry of buyers into the market, with aspirations for further increases. However, Bitcoin is currently trading within a critical range, with resistance firm at $61.6K and support anchored between the established Fibonacci levels. It is anticipated that a brief period of consolidation may transpire. Assessing the 4-hour chart reveals that Bitcoin has successfully reversed at the $53K support level, aligning well with the 0.618 Fibonacci level, which instigated a steady upward trajectory. The absence of a new lower low in the $52K-$54K range is an indicator of significant buying interest that has effectively halted the previous bearish trend. Bitcoin is now nearing the key resistance area around $65K, historically recognized as a formidable barrier for price increases. Should buyers succeed in pushing the price above this pivotal zone, the subsequent target will be set at the $70K resistance. Conversely, if the price encounters rejection at $65K, a bearish correction towards the psychological support levels of $52K-$54K may ensue. On-Chain Analysis The MVRV (Market Value to Realized Value) ratio, a popular sentiment indicator within the cryptocurrency market, is derived by dividing the market capitalization by the realized cap. A ratio falling below 1 often signals that the majority of investors are enduring losses, a scenario frequently linked to potential bear market bottoms that can persist over extended durations. Currently, the MVRV ratio has dipped below its 365-day moving average, a crucial threshold that has historically indicated the commencement of market recoveries. While this decline may present a potential opportunity for long-term investors, it is advisable to exercise caution. A substantial recovery is usually indicated when the MVRV ratio rebounds above this significant level. In previous market cycles, such a resurgence has often been a pivotal moment leading to renewed investor confidence. Nonetheless, the prevailing environment, marked by intensified fear and uncertainty, suggests that any recovery may take longer to materialize. It is paramount to approach this period with caution and patience.

The subject of this article revolves around the recent performance of Bitcoin (BTC) in the cryptocurrency market. Bitcoin has shown marked volatility but currently illustrates signs of a bullish trend following reversals from strong support levels defined by Fibonacci retracement levels. Moreover, moving averages and the MVRV ratio are applied as analytical tools to gauge potential price movements and market sentiments, offering insight into investors’ behaviors, future expectations, and strategic decisions in navigating Bitcoin’s market dynamics.

In conclusion, Bitcoin’s current trajectory following a strong bullish reversal indicates a promising potential to approach the $65K resistance level. However, significant selling pressure is expected around the 100-day moving average at $61.6K, suggesting a period of consolidation may be on the horizon. The MVRV ratio points to cautious optimism for long-term recovery, yet prevailing market sentiments warrant vigilance. Investors must remain prudent in their strategies, carefully weighing the risks and opportunities within this volatile environment.

Original Source: cryptopotato.com

Post Comment