BlackRock and Bitcoin ETFs: Key Players in BTC Price Stability

Summary

Bloomberg analyst Eric Balchunas asserts that BlackRock and Bitcoin ETFs have been instrumental in preventing significant declines in Bitcoin prices, countering the narrative that traditional investors are responsible for downturns. He attributes price drops to native holders and cites recent sales by Bitcoin miners. Additionally, allegations suggest Coinbase may be facilitating price suppression for BlackRock through Bitcoin IOUs, a claim Coinbase’s CEO has refuted.

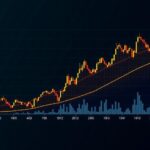

Bloomberg analyst Eric Balchunas has argued that BlackRock and Bitcoin Exchange-Traded Funds (ETFs) have played a crucial role in stabilizing Bitcoin prices during significant downturns. In his recent statements, Balchunas emphasized that the decline in Bitcoin’s value is primarily attributed to native holders, rather than traditional investors such as BlackRock. He pointed out that claims blaming ETF-related traditional investors for Bitcoin’s price drops are misleading. Balchunas further clarified that the true cause of price declines stems from the actions of Bitcoin natives, whom he views as the primary sellers in the market. Supporting this assertion, crypto analyst Ali Martinez noted that Bitcoin miners had liquidated over 30,000 BTC within a three-day period, demonstrating the internal pressure exerted on the price. The introduction of Bitcoin ETFs, particularly those linked with BlackRock, has significantly contributed to reaching new heights in Bitcoin’s market value, with reports indicating an all-time high of approximately $73,000 in March of this year. Since the launch of these ETFs, BlackRock has managed to avoid substantial outflows, suggesting a strong confidence in the asset. The narrative surrounding Coinbase’s alleged complicity has also emerged, with accusations claiming that the exchange is generating Bitcoin IOUs for BlackRock, which potentially allows for price suppression. Crypto analyst Tyler Durden has suggested that this arrangement permits BlackRock to short Bitcoin without the requirement to hold actual Bitcoin on a one-to-one basis. Coinbase’s CEO, Brian Armstrong, has publicly dismissed these allegations, assuring the public that all transactions are properly audited, and the identities of institutional clients remain confidential. Currently, Bitcoin is trading near $60,000, with speculations suggesting that impending rate cuts may positively impact its price. Historically, such macroeconomic adjustments have yielded bullish trends for Bitcoin.

The growth of Bitcoin ETFs has been a significant topic within cryptocurrency markets, especially concerning their influence on Bitcoin’s market behavior and price stability. BlackRock, being a leading asset manager, has entered the cryptocurrency space, making considerable investments in Bitcoin ETFs. Analysts have observed fluctuations in Bitcoin’s price and speculated on the influence of traditional finance on the cryptocurrency market, leading to diverse opinions regarding the responsible parties for these price movements.

In conclusion, Eric Balchunas’s insights shine a light on the dynamics influencing Bitcoin’s price stability, indicating that traditional investors are not solely responsible for market fluctuations. The significant involvement of Bitcoin natives in selling activities raises questions about the overall market sentiment. Furthermore, the allegations surrounding Coinbase’s operations with BlackRock highlight ongoing concerns regarding market manipulation and transparency. As Bitcoin continues to navigate its volatile path, the interplay between institutional and native investor activities will remain critical to understanding its price movements.

Original Source: coingape.com

Post Comment