Bullish Bitcoin Price Predictions Post-Halving Year

Summary

This article discusses Bitcoin’s historical performance post-halving, which suggests a bullish outlook for price predictions, particularly in Q4. The current low in miners’ revenue points to a potential price rebound. Predictions from various financial experts indicate Bitcoin could reach targets between $100,000 and $13 million within the next couple of years, with historical trends supporting these forecasts.

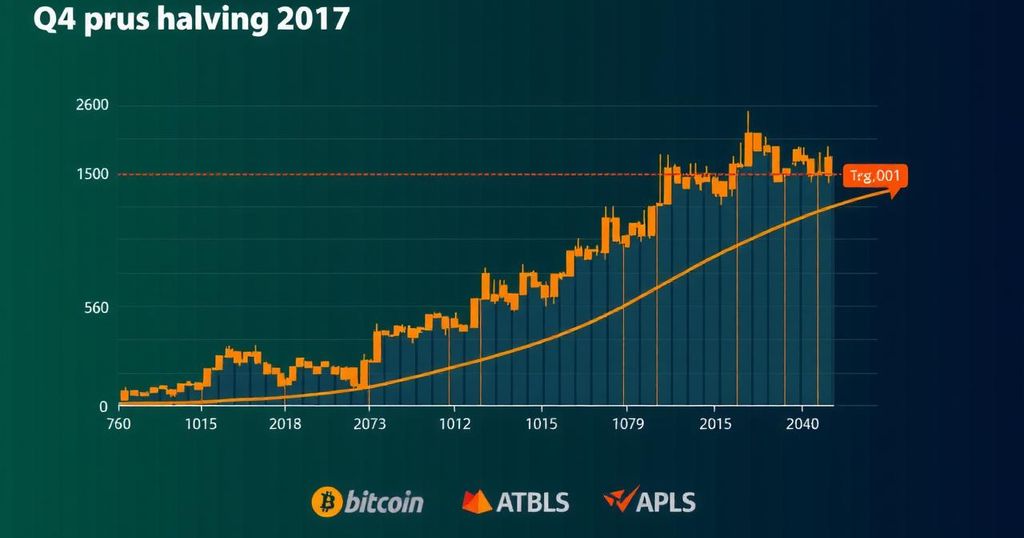

Five months have elapsed since Bitcoin’s fourth halving event, which took place in April, and predictions regarding the cryptocurrency’s price are increasingly optimistic. Historically, Bitcoin tends to excel in the final quarter of halving years, an observation supported by data from previous cycles, which indicates significant price increases during this period. Additionally, miners’ revenue is currently at a four-year low, a trend which often precedes a price rebound for the cryptocurrency. Are investors prepared for Bitcoin to potentially trade at $100,000? To comprehend future predictions for Bitcoin’s price, it is necessary to analyze historical post-halving performance. The halving, which occurs every four years, has historically led to price increases, although not uniformly across all months of that year. In reviewing Bitcoin’s past movements post-halving, Investor Lark Davis has highlighted remarkable price growth during the last quarter (Q4) of previous halving years. For instance, in Q4 of 2012, Bitcoin appreciated by 8.47%, while in 2016 and 2020, those increases were considerably higher, at 58.17% and 168.02%, respectively. Overall, the average growth for Bitcoin in these Q4 periods stands at 88.84%, suggesting a strong potential for price surges in the upcoming months. Furthermore, Q1 and Q3 following the halving years have also displayed encouraging returns; for example, an astonishing 539.96% increase in Q1 of 2013 and a 103.17% increase in Q1 of 2021. If historical patterns hold, a positive outlook exists for three out of the next four quarters. As part of the analysis, it is essential to observe miners’ revenue, which is currently at a historic low after the recent halving. This reduction in revenue tends to suggest a future rebound in Bitcoin’s price, aligning with patterns observed in past cycles. Expert Quinten Francois notes that we may indeed be nearing the lowest point for miner profitability, anticipating a subsequent trend reversal. Historically, such circumstances have often led to rising prices in the months following a halving. Delving into future forecasts, prominent financial institutions have made bold predictions about Bitcoin’s price trajectory. In early 2024, Standard Chartered projected a price target of $100,000, which was later elevated to $150,000, and they foresee a potential peak of $250,000 by 2025. Jan Van Eck, CEO of Vaneck, a $90 billion hedge fund, has expressed an even more bullish forecast, suggesting Bitcoin could reach $350,000, citing digital scarcity and widespread adoption as key drivers. Lastly, Michael Saylor, CEO of Microstrategy, has conveyed an ambitious outlook, predicting that Bitcoin could surpass $13 million in value over the next two decades. Conversely, more conservative analysts, such as those at DigitalCoinPrice, estimate a price range of $52,000 to $121,000 in 2024, with future values potentially oscillating between $392,000 and $435,000 by 2030.

The background of this article centers on Bitcoin’s cyclical nature, particularly the significant price movements historically observed during and after its halving events. The halving, which reduces the reward for mining Bitcoin, typically creates supply constraints that impact prices positively. This article explores the implications of this phenomenon in relation to miners’ revenues and upcoming trading prospects, ultimately contextualizing current projections within a historical framework of performance.

In conclusion, the analysis presented reflects a robust historical precedent for Bitcoin’s price performance during Q4 following halving events. Various expert predictions indicate a potentially bullish trajectory for Bitcoin, culminating in price targets that reach as high as $350,000 to $13 million over forthcoming years. The current low levels of miners’ revenue further suggest an impending price rebound. As the market watches closely, there remains optimism for significant growth, especially as 2024 unfolds.

Original Source: en.cryptonomist.ch

Post Comment