Bitcoin (BTC) Price Trends: Potential Upside Following Halving History

Summary

Bitcoin (BTC) has fallen from its peak of $73,777 since March 14 but rebounded in August, suggesting potential upward movement. Historically, BTC prices have surged following halving events, and with the fourth halving occurring in April 2024, analysts anticipate similar behavior could unfold soon. The current wave count indicates a possible final dip before a robust increase, with target prices set at $88,950 and $112,717. Positive institutional investment news may bolster this potential rally.

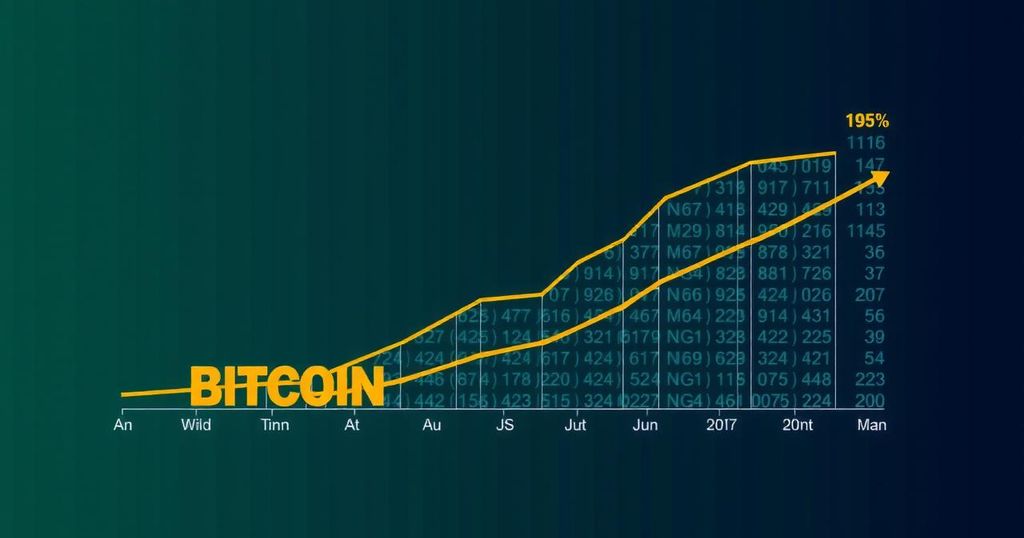

The price of Bitcoin (BTC) has experienced a decline since reaching an all-time high of $73,777 on March 14, dropping gradually by less than 20% over 187 days. However, on August 5, BTC made a notable rebound, forming a higher low on September 6, signaling potential bullish behavior. This analysis aims to investigate Bitcoin’s halving history to discern any patterns that may predict future price trends for 2024. Bitcoin’s third halving took place on May 11, 2020, followed by the fourth halving on April 20, 2024. Post the 2020 halving, Bitcoin’s price surged almost immediately, followed by a brief pause before resuming its upward trajectory in September, leading to substantial price increases starting 160 days after the event. Crypto analyst TheCryptoLark highlighted that it has been 151 days since the most recent halving. Currently, Bitcoin’s price has undergone a downward trend that persisted post-halving, but a reversal occurred in August with the formation of a higher low in September. Should historical patterns hold true, BTC may begin another ascent as soon as next week, which would mark 161 days post-halving. The wave count analysis aligns with this halving fractal, indicating that the fourth wave correction may conclude imminently. According to this count, following a five-wave increase initiated in November 2022, Bitcoin is set to embark on its fifth and final wave. The fourth wave has developed into a complex W-X-Y correction, wherein sub-wave Y formed a symmetrical triangle. If the predictions are accurate, one final dip may precede Bitcoin’s rise. The first target for this anticipated increase is forecasted at $88,950, based on a 1.61 external retracement of wave four. Notably, it is atypical for wave five to be shorter than wave one; should this occur, BTC may ascend to a high of $112,717 before experiencing a correction. Additionally, positive news surrounding Bitcoin has emerged. MicroStrategy has announced a private offering of $700 million in notes aimed at acquiring more BTC, augmenting its existing holdings that total approximately $14 billion. Furthermore, recent data from Arkham Intelligence indicates that the Kingdom of Bhutan currently possesses around $750 million in Bitcoin following a recent acquisition. A fractal that juxtaposes the previous halving cycle with the present one implies that BTC is on the verge of entering a parabolic rally. The wave count corroborates this theory, predicting that a correction will conclude next week, with initial upward targets set at $88,950 and $112,717.

Bitcoin has been a subject of significant attention, particularly during its halving events which historically correlate with price increases. The previous halvings have often marked periods of notable market activity, suggesting that monitoring these events can be crucial for investors. The current analysis focuses on the fourth halving that occurred in April 2024 and examines how the trends that followed previous halvings may repeat. Understanding Bitcoin’s historical price behavior post-halving provides context for predicting future movements, especially in light of recent market reactions and institutional investments.

In summary, Bitcoin’s recent price movements suggest a possible upward trend similar to past halving events. Following the fourth halving, analysts predict that BTC may commence a significant rally, with potential price targets of $88,950 and $112,717, contingent upon the completion of the current wave correction. Institutional interest, reflected through MicroStrategy’s recent announcements and the Kingdom of Bhutan’s substantial holdings, further supports bullish sentiment in the market. This analysis thus posits that Bitcoin may soon embark on its next upward movement, expanding upon historical precedents and current wave structures.

Original Source: www.ccn.com

Post Comment