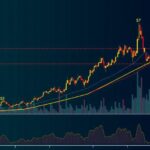

Bitcoin Price Rises to $60K Amid Anticipation of Rate Cuts and Positive ETF Flows

Summary

Bitcoin’s price surged to $60,469.1, rising 3.8%, driven by expectations of an interest rate cut by the Federal Reserve and improved capital flows into Bitcoin ETFs. MicroStrategy’s significant Bitcoin purchases further solidified its position in the market, while other cryptocurrencies experienced modest gains as sentiment remained optimistic.

Bitcoin’s price experienced a notable increase on Wednesday, reaching $60,469.1, marking a rise of 3.8% as market participants anticipated an interest rate reduction by the Federal Reserve. This price surge came in conjunction with positive data showing a rebound in capital flows into spot exchange-traded funds (ETFs) after a period of outflows, contributing to an overall optimistic sentiment within the cryptocurrency market. Throughout September, Bitcoin had primarily traded within the range of $50,000 to $60,000, and the broader cryptocurrency market also reacted positively to the possibility of lower U.S. interest rates, which are generally considered advantageous for risk-oriented and speculative investment vehicles. Additionally, recent reports indicated that BlackRock’s iShares Bitcoin Trust recorded its first influx of capital in two weeks on Monday, following a prolonged period of outflows that had persisted since mid-August. This influx signified a shift in sentiment, particularly as concerns regarding the upcoming U.S. presidential election, interest rates, and the looming specter of a potential recession had previously cast a shadow over cryptocurrency valuations. In related news, MicroStrategy Incorporated has made headlines with its acquisition of approximately $1.1 billion worth of Bitcoin between August 6 and September 12, thereby consolidating its position as the largest corporate holder of the cryptocurrency, with total holdings valued at around $9.5 billion. The firm also announced plans to raise approximately $700 million through a private issuance of convertible bonds due in 2028, which will be utilized for repaying existing debt obligations and for further Bitcoin purchases. Meanwhile, broader trends in cryptocurrency indicated a general upward movement, with the second-largest digital asset, Ether, rising by 1.4% to $2,319.94. Other altcoins such as XRP, Solana, and Cardano fluctuated within a low range. Even meme-based tokens like Dogecoin saw a modest increase of 0.2% during this period. Analysts widely expect the Federal Reserve to implement an interest rate cut later on Wednesday, a decision that is anticipated to contribute to a liquidity influx, subsequently facilitating investment into speculative areas such as cryptocurrency.

The recent fluctuations in Bitcoin’s price are closely tied to the macroeconomic environment, particularly the anticipated decisions of the Federal Reserve regarding interest rates. The relationship between interest rates and cryptocurrency market dynamics is critical, as lower rates tend to enhance liquidity in the market, encouraging investment in riskier assets. In recent weeks, the cryptocurrency sector has been influenced by various factors, including changing investor sentiment surrounding Bitcoin ETFs, corporate purchases of Bitcoin, and macroeconomic indicators pointing towards a potential recession. Understanding these factors is crucial for grasping the current movements in cryptocurrency prices.

In summary, Bitcoin’s surge to $60,469.1 reflects not only market optimism over anticipated interest rate cuts by the Federal Reserve but also a recovery in ETF capital flows after recent outflows. The engagement of significant corporate players like MicroStrategy further validates the ongoing institutional interest in cryptocurrency. As the market anticipates the Fed’s decisions, it remains positioned for continued fluctuations driven by broader economic factors.

Original Source: www.investing.com

Post Comment