Bitcoin Surges Over 4% as Bitcoin Market Rallies Ahead of Federal Interest Rate Meeting

Summary

Today, Bitcoin has risen approximately 4.08% to hit around $60,517 after recovering from recent losses, with major altcoins like Ethereum and Dogecoin gaining up to 1.5%. Market optimism is fueled by expectations of a significant interest rate cut during the Federal Open Market Committee meeting, potentially impacting liquidity in the crypto space. Despite some altcoins declining, others have surged, showcasing a mixed yet generally positive trading environment.

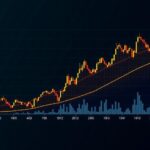

On the morning of [insert date], the cryptocurrency market witnessed a significant recovery, particularly with Bitcoin (BTC) surging to approximately $60,517, registering an increase of around 4.08% in the last 24 hours. This rebound follows a period of losses earlier in the week, thereby extending Bitcoin’s seven-day performance to nearly 7%. Key altcoins such as Ethereum (ETH), Tether, BNB, and Dogecoin experienced modest gains of up to 1.5% around 1:15 PM. However, some cryptocurrencies, including Solana, XRP, and Avalanche, faced declines, falling by as much as 1.4%. Market optimism is largely attributable to anticipations surrounding the Federal Open Market Committee (FOMC) meeting, where analysts speculate a significant interest rate cut—the first of its kind in four years. Shivam Thakral, CEO of BuyUcoin, stated that the current futures pricing reflects a 65% probability of a 50 basis-point reduction in interest rates. This potential easing of monetary policy is expected to enhance liquidity and likely contribute to ongoing bullish sentiments in the crypto market. Additionally, the introduction of a governance token by the World Liberty Financial crypto project, supported by former President Donald Trump, has generated further excitement in the sector. Thakral noted that despite the token being non-transferable and lacking economic rights, its launch signifies a growing interest in cryptocurrency. In tandem with Bitcoin’s recovery, altcoins such as SUI, IMX, and FTM have enjoyed significant price increases of over 10% in the past day, even as Ethereum faced a retracement. With Bitcoin’s dominance now rising to 58%, market analysts have highlighted a dip in the ETH/BTC ratio to its lowest point in over three years. CoinSwitch Markets Desk continues to predict a 50 basis-point cut by the Federal Reserve, citing that macroeconomic conditions are affecting sentiments beyond the United States, particularly with lackluster economic data emerging from China.

The cryptocurrency market is highly sensitive to macroeconomic factors, particularly actions taken by central banks such as the Federal Reserve. The anticipation of interest rate cuts often influences liquidity levels within the market, modifying investor behavior and sentiment. Additionally, the participation of high-profile individuals and endorsements in crypto initiatives can drastically alter market dynamics and investor interest. The trends observed today reflect these interconnected influences and highlight how regulatory frameworks alongside economic reports shape the trajectory of cryptocurrencies like Bitcoin and Ethereum in particular.

In conclusion, Bitcoin’s current rally, orthat of various altcoins, highlights the positive influence of anticipated monetary policy adjustments and economic sentiment. With cryptocurrencies rebounding amidst expectations of a Federal interest rate cut, the outlook remains optimistic for digital assets. However, as market dynamics continue to evolve, investors remain vigilant of external economic indicators that could impact future movements. The rise in Bitcoin’s dominance underscores its foundational role within the crypto ecosystem, even as altcoins navigate a mixed trading environment.

Original Source: m.economictimes.com

Post Comment