Arthur Hayes: Is the Fed’s Rate Hike a Recipe for Financial Turmoil?

Summary

Arthur Hayes discusses the potential consequences of the Federal Reserve implementing a rate cut of 25 or 50 basis points, weighing the risk of financial turmoil against the chance of a temporary market rally. He emphasizes the complexities of interest rate impacts on liquidity and investment sentiment.

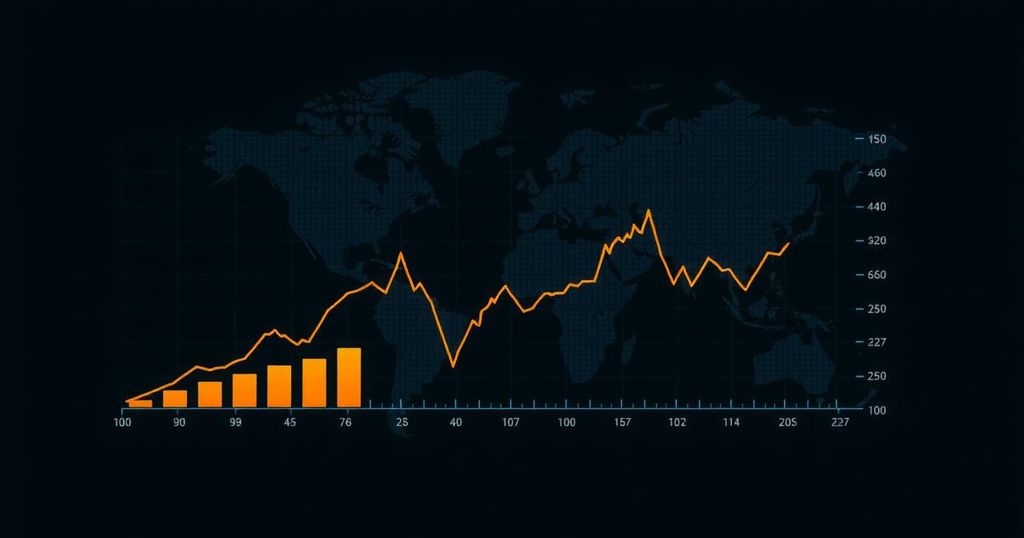

Arthur Hayes, the co-founder of BitMEX and Chief Investment Officer at Maelstrom, presents a critical analysis regarding the implications of a potential Federal Reserve rate cut. He suggests that adjustments to the Fed funds rate, whether a reduction of 25 or 50 basis points, could evoke contrasting scenarios: a possible financial catastrophe or, alternatively, a temporary market rally. Hayes emphasizes that the interactions between interest rates and market dynamics are complex and could lead to unpredictable outcomes in the financial sphere. As market participants speculate about the Federal Reserve’s next moves, Hayes cautions that monetary policy decisions have significant ramifications for liquidity and investment sentiment. A reduction in interest rates might provide immediate relief in terms of reduced borrowing costs, yet it could also instigate fears of economic instability, leading to market turbulence.

The Federal Reserve plays a crucial role in regulating the economy, primarily through its control over interest rates. The adjustment of the Federal funds rate is a pivotal tool used to influence economic activity. Lowering the rate can stimulate spending and investment; however, it may simultaneously reflect underlying economic challenges. The discourse surrounding interest rate cuts has intensified as market analysts and investors seek insights into the possible repercussions on financial stability and asset prices. Arthur Hayes’s expertise in cryptocurrency and market trends positions him as a notable commentator on these developments, particularly in relation to the broader implications for both digital currencies and traditional finance.

In summary, Arthur Hayes articulates the dual possibilities that a Federal Reserve rate cut presents. The potential for a financial rally exists alongside the risk of instigating turmoil within markets. As the landscape of economic policy evolves, stakeholders must remain vigilant and consider both immediate outcomes and long-term impacts. Hayes’s insights underline the intricate relationship between monetary policy and market dynamics, inviting further discourse on the subject.

Original Source: www.coindesk.com

Post Comment