Bitcoin Price Forecast: Impact of Recent Fed Rate Cut on Potential Bull Run

Summary

The US Federal Reserve has unexpectedly cut its key lending rate by 50 basis points, prompting a surge in Bitcoin’s price to $61,783, raising questions about the potential for a new bull run. Following a bullish trend within the cryptocurrency market, Bitcoin has demonstrated significant growth amidst declining traditional assets, highlighting the impact of Federal Reserve policies on speculative investments.

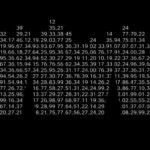

The United States Federal Reserve’s unexpected decision to cut its key lending rate by 50 basis points has stirred significant movements within the financial markets. While conventional asset classes faced declines post-announcement, more speculative assets such as Bitcoin witnessed notable gains, establishing a potential bullish trend. Bitcoin’s price surged to a new monthly high of $61,783, stirring discussions among investors regarding the possibility of a new bull run. This development raises questions about the trajectory of Bitcoin amidst fluctuations in mainstream asset performance. Initially anticipated to be a 25 or 50 basis point adjustment, the Fed’s ultimate decision surprised many, emphasizing the potential inflation risks associated with such a substantial cut. In the realm of cryptocurrency, Bitcoin has exhibited a growth of approximately 2.9% within the last 24 hours alone, rebounding from a monthly low of $53,973. Following an upward trend that began on September 7, it is evident that Bitcoin is experiencing strong bullish momentum, highlighted by three consecutive days of robust price increases. Moreover, this rate adjustment marks the first such cut from the Federal Reserve since March 2020, following a prolonged period of rising rates which peaked at 5.5%. The current rate now stands at 5%, as the economic landscape continues to adjust to shifting monetary policies. The implications of this rate cut may further enhance the performance of risk-oriented assets such as Bitcoin, which have already begun to display promising growth indicators.

The recent decision by the US Federal Reserve to cut interest rates by 50 basis points is significant, considering the backdrop of rising rates since February 2022, when the interest rate was merely 0.25%. The move comes amidst ongoing discussions about the impact on inflation and the health of various asset classes. Historically, interest rate cuts tend to stimulate investment in riskier assets as lower borrowing costs can spur economic growth. In this context, the cryptocurrency market, particularly Bitcoin, is closely watched as market participants seek indications of bullish trends.

The Federal Reserve’s unexpected decision to implement a 50 basis point rate cut has created an environment ripe for potential growth in the cryptocurrency market, particularly Bitcoin. Following the announcement, Bitcoin has reached new monthly highs, displaying bullish momentum that could indicate the beginning of a new bull run. As investors monitor market responses, the implications of the Fed’s policies on risk assets will continue to draw attention in the coming weeks.

Original Source: coinpedia.org

Post Comment