Bitcoin Price Surge Following Fed’s Historic Interest Rate Cut

Summary

Bitcoin experienced a notable price increase, soaring to $62,000 following a 50 basis point interest rate cut by the Federal Reserve, marking its first reduction in four years. This move is anticipated to boost borrowing and spending, which is favorable for cryptocurrencies. Historical trends indicate that such rate cuts are often bullish for Bitcoin. However, other factors such as global economic conditions and central bank policies will be pivotal in determining Bitcoin’s future trajectory.

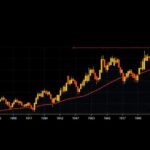

Bitcoin’s price surged to $62,000 following the Federal Reserve’s historic decision to cut interest rates by 50 basis points (0.5%) for the first time in four years, lowering the target rate to a range of 4.75%-5.00%. In the days leading up to this announcement, Bitcoin had already experienced a significant incline, rising nearly 16% from its September 6 low. The anticipated implications of this interest rate reduction, in combination with the Bank of Japan’s forthcoming decisions on interest rates, are projected to heavily influence market sentiment and Bitcoin’s trajectory. This recent move by the Fed marks a pivotal moment in monetary policy and has historically been linked with bullish outcomes for Bitcoin, as seen in previous instances where interest rates were similarly lowered. Historically, periods of interest rate cuts have led to favorable conditions for cryptocurrencies. For instance, Bitcoin enjoyed a near 30% increase in value shortly after the July 2019 rate cuts. Additionally, there was a monumental 50% price surge following an emergency rate cut by the Fed in March 2020, attributed to the onset of the COVID-19 pandemic. This historical correlation does suggest that the recent rate cut could further propel Bitcoin’s value; however, it is crucial to consider that external factors may counteract this potential upward trend. Complex variables including global economic conditions, inflation expectations, regulatory environments, and institutional investments are equally significant in determining Bitcoin’s price movements. Specifically, the upcoming interest rate decision by the Bank of Japan may introduce volatility into financial markets due to its previous impact on currency trading dynamics. Participants in the market are closely monitoring these developments, as they could dictate the overarching bullish sentiment surrounding Bitcoin. While there exists optimism among investors for Bitcoin’s prospective increase, with forecasts suggesting prices could exceed $65,000, it is essential to remain vigilant of external influences that might act as impediments to sustained growth. Investors and market analysts alike will be keen observers of these factors moving forward, particularly the Bank of Japan’s actions and their consequent impacts on sentiment toward Bitcoin.

The Federal Reserve recently made a significant policy shift by cutting interest rates for the first time in four years, initiating economic changes that are expected to reverberate throughout various markets, including cryptocurrencies like Bitcoin. Interest rates play a crucial role in determining the borrowing and spending behavior of investors. A decrease in interest rates typically makes borrowing cheaper, which can stimulate economic activity and lead to bullish trends in risk-on assets such as stocks and cryptocurrencies. Historically, similar rate cuts have led to substantial increases in Bitcoin’s price, making this a noteworthy event for cryptocurrency investors and market participants. Furthermore, external economic indicators and decisions from other central banks, such as the Bank of Japan, are also pivotal. Any changes from the BOJ have the potential to shift market sentiment drastically, underscoring the interconnectedness of global financial markets. Thus, understanding the broader economic landscape and the implications of central bank policies is essential for predicting Bitcoin’s performance.

In summary, Bitcoin’s recent ascent to $62,000 is directly correlated with the Federal Reserve’s decision to reduce interest rates, marking a pivotal moment for both the cryptocurrency and broader economic landscape. While historical trends suggest that such rate cuts enhance Bitcoin’s price, numerous external factors, including economic conditions, regulatory uncertainties, and international monetary policies, could significantly impact future movements in Bitcoin’s valuation. Investors remain cautiously optimistic about Bitcoin’s prospects, yet vigilance is warranted given the dynamic nature of the financial markets. As events unfold, particularly in relation to the Bank of Japan’s monetary policy, market participants are poised to respond accordingly.

Original Source: coingape.com

Post Comment