Bitcoin’s Growth Predicted Post Interest Rate Cut: Insights from Standard Chartered

Summary

Geoff Kendrick of Standard Chartered predicts that Bitcoin could experience substantial growth following a 50 basis point interest rate cut by the U.S. Federal Reserve. He believes macroeconomic factors are becoming more influential than political events, noting a resurgence in digital asset performance and the potential for increased ETF investments. Kendrick forecasts Bitcoin could reach between $75,000 and $125,000 by the end of 2024, depending on the outcome of the presidential election.

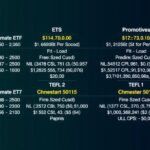

According to Geoff Kendrick, who leads forex and digital assets research at Standard Chartered, the expected surge in Bitcoin and the broader digital asset market is primarily linked to the U.S. Federal Reserve’s recent decision to cut interest rates by 50 basis points. Kendrick emphasized that although forthcoming political events, such as the U.S. presidential election, play a part, economic trends are now taking precedence in influencing digital asset values. Following the Federal Open Market Committee (FOMC) meeting, which resulted in an interest rate reduction, Kendrick noted, “digital assets are at the top of the pack in terms of performance, for the first time in a while.” He observed that this performance improvement occurs despite current electoral predictions reflecting a tightly contested race, with data indicating a slight advantage for Kamala Harris. Kendrick asserted that the impact of the U.S. presidential election on Bitcoin’s price trajectory has diminished compared to earlier cycles, stating, “While the U.S. election is important, macro drivers are starting to take over.” He highlighted the significance of the U.S. Treasury yield curve, indicating that a steepening yield curve tends to be favorable for digital assets. Notably, the yield curve, which had been inverted since July 2022, has reverted to a positive slope, suggesting a favorable shift in market sentiment that could augment digital asset prices. Additionally, Kendrick anticipates a rise in investment toward spot Bitcoin exchange-traded funds (ETFs) in the upcoming months, potentially providing further support to the market. He stated, “Watch for renewed spot bitcoin exchange-traded fund inflows in October.” While acknowledging the political landscape remains pertinent, he stressed that macroeconomic factors such as interest rate fluctuations and market liquidity will exert a more significant influence on Bitcoin’s pricing trends. Kendrick reiterated his forecast, expecting Bitcoin to potentially reach new all-time highs by the end of 2024, estimating values of $125,000 in the event of a Donald Trump presidency and $75,000 should Kamala Harris become president. This prediction surpasses the findings of a Deutsche Bank survey, where only 12% of respondents anticipated Bitcoin exceeding $70,000 by year’s end. As the digital asset landscape evolves, Kendrick’s insights underline the importance of macroeconomic shifts and their impacts on cryptocurrencies. Key discussions surrounding these dynamics will occur at Benzinga’s Future of Digital Assets event later this November, where industry authorities will assess the interplay between regulatory changes, economic variables, and political factors shaping the future of digital finance.

The discussion surrounding Bitcoin’s potential growth is rooted in the macroeconomic environment impacted by U.S. Federal Reserve interest rate cuts. The FOMC policy decisions have a direct influence on market liquidity and general investment sentiment towards digital assets. Given the growing complexity of market drivers, such as the yield curve movements and the relationship between political events and economic indicators, the focus has shifted predominantly towards macroeconomic factors as primary influencers of Bitcoin value. Kendrick’s insights reflect a broader trend in digital asset analysis, where investors and analysts are increasingly examining the implications of economic policies over political events.

In summary, the perspective offered by Geoff Kendrick of Standard Chartered highlights a significant transition in the drivers of Bitcoin’s valuation, underscoring the importance of macroeconomic factors in shaping the market. The recent interest rate cut by the Federal Reserve appears to catalyze a renewed interest in Bitcoin, compounded by a favorable shift in the yield curve and potential growth in ETF investments. Kendrick’s optimistic forecasts signal a potentially volatile yet bullish outlook for Bitcoin over the next year, reinforcing the idea that macroeconomic trends are now paramount in determining the digital asset’s future.

Original Source: www.benzinga.com

Post Comment