Dogecoin Founder Critiques Bitcoin Response to Federal Rate Cut

Summary

Billy Markus, co-founder of Dogecoin, humorously critiqued Bitcoin’s market response to the Federal Reserve’s recent 50 basis points interest rate cut. While investors expected a surge due to the rate reduction and an upcoming Bitcoin halving, the price initially fell sharply before recovering. Markus also commented on Ethereum co-founder Vitalik Buterin’s controversial performance at a crypto conference, expressing a desire to see such events banned.

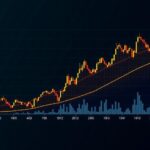

Billy Markus, widely recognized by his pseudonym Shibetoshi Nakamoto and as the co-founder of the popular meme-based cryptocurrency Dogecoin in 2013, has expressed his remarks on the recent reactions of Bitcoin prices following a significant interest rate cut by the U.S. Federal Reserve. In a characteristic sarcastic tone, Markus highlighted that Bitcoin, the largest cryptocurrency by market capitalization, did not meet the optimistic expectations projected by its supporters. During the Federal Open Market Committee (FOMC) meeting held on Wednesday, the Federal Reserve announced a long-anticipated interest rate decrease of 50 basis points. Just days before the announcement, financial experts debated whether the cut would be 25 or 50 basis points, with the latter ultimately confirmed by Federal Reserve Chairman Jerome Powell. This marked the first reduction in interest rates since the onset of the COVID-19 pandemic in 2020, a year that also saw Bitcoin undergo its third halving event, which contributed to its record highs in 2021, reaching nearly $69,000 late in the fall. Investors had high hopes for Bitcoin following the rate cut and the impending halving scheduled for April 2024. Initially, Bitcoin’s price experienced a minor increase, only to sharply decline once the announcement was made. Markus drew attention to this unexpected price behavior by sharing screenshots displaying the fluctuations of the S&P 500 index, alongside Bitcoin (BTC/USD) and Ethereum (ETH/USD), illustrating the rise and subsequent fall in cryptocurrency values. Despite the earlier decline, Bitcoin has since demonstrated a recovery, achieving a notable increase of 4.64%, rebounding from its low of $59,380 to $62,135 after the interest rate decrease. In addition to his commentary on Bitcoin, Markus criticized Ethereum co-founder Vitalik Buterin, who had recently performed at the TOKEN2049 crypto and blockchain conference in Singapore. Both Markus and notable Bitcoin maximalist Samson Mow expressed their discontent regarding the performance, with Markus voicing a wish for a prohibition on such crypto conferences altogether while Mow suggested that Buterin’s performance further confirmed his belief that Ethereum was losing its relevance.

The U.S. Federal Reserve plays a significant role in regulating monetary policy, and interest rate adjustments can have profound impacts on the financial markets, including cryptocurrencies. A rate cut often signals a shift towards stimulating the economy but can lead to varying reactions in risk-oriented assets like cryptocurrencies. The halving of Bitcoin, an event that occurs approximately every four years, reduces the rewards for mining new blocks and historically leads to price surges due to reduced supply coupled with consistent demand. The juxtaposition of these factors—macroeconomic policy shifts and fundamental developments within Bitcoin—shapes investor expectations and sentiments, often resulting in volatile market reactions.

In summary, Billy Markus’s critique serves as a reminder of the unpredictability inherent in the cryptocurrency market, where even significant economic indicators such as interest rate cuts can lead to contrary performance outcomes. His observations on Bitcoin’s failure to rally as anticipated, alongside his comments regarding the broader crypto community, reflect ongoing discussions about market dynamics and the evolving nature of cryptocurrency events. The Fed’s interest rate decision, combined with the upcoming Bitcoin halving, continues to influence investor behavior and price trajectories in the crypto sector.

Original Source: u.today

Post Comment