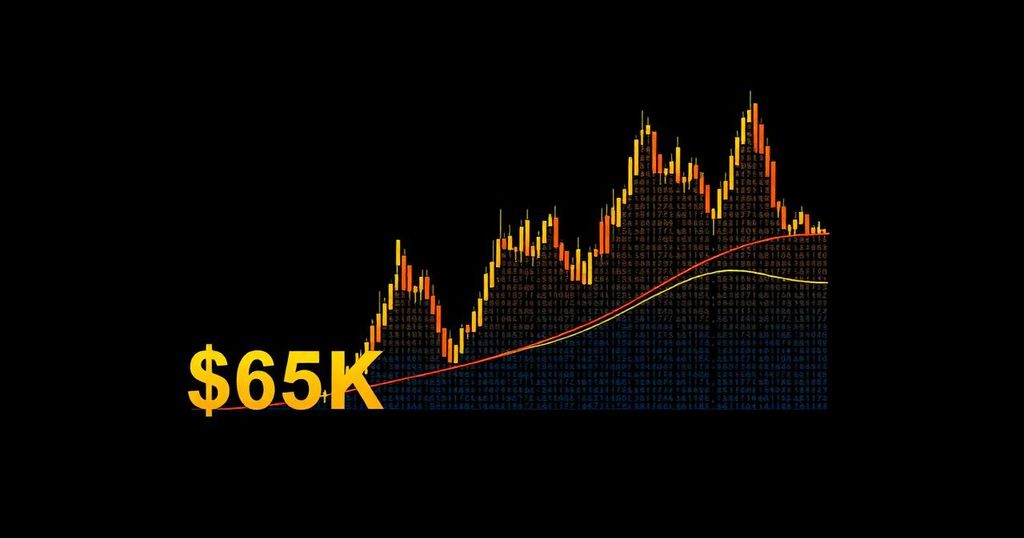

Bitcoin Approaches Key Resistance Level of $65,000 as Traders Remain Optimistic

Summary

Bitcoin traders recognize $65,000 as a critical resistance level, with recent price actions showing positive momentum reaching $64,121. Analyst sentiments indicate potential for a bullish market shift, supported by strong buyer interest primarily on Binance. Overall, the market outlook remains optimistic as BTC seeks to navigate this key price barrier.

Bitcoin traders have identified the price point of $65,000 as a significant resistance level to surpass, indicating its critical importance in the current market dynamics. Recent data from Cointelegraph Markets Pro and TradingView indicated that Bitcoin’s price rallied to a three-week high of $64,121 on Bitstamp. This movement occurred in the context of broader market shifts, as the S&P 500 and Nasdaq 100 both experienced declines following an interest rate cut from the Federal Reserve on September 18. Despite the dip in traditional markets, Bitcoin managed to recover swiftly, with notable positive sentiment expressed by prominent cryptocurrency analysts. Trader Roman observed, “Price action looking bullish with low volume as we’re correcting / forming volatility to break 65k resistance.” Daan Crypto Trades highlighted the $65,000 level, stating, “This is a big level in terms of liquidity as well as it would signal a bullish market structure break.” Furthermore, market analysts noted that recent price actions had resulted in only lower highs, but if Bitcoin closes above $64,000 on a weekly basis, it may indicate a shift towards a more bullish market structure. An analysis from the on-chain platform CryptoQuant revealed that the buying interest on Binance has surpassed that on Coinbase, as reflected in a negative Coinbase premium, suggesting robust buying pressure on Binance. The overall outlook within the trading community is optimistic, provided that this momentum continues to grow beyond U.S. markets, driven by global market interest.

The current analysis of Bitcoin’s market dynamics comes against a backdrop of fluctuating financial markets and changing investor sentiment. The delineation of critical resistance levels, such as $65,000, is pivotal for traders and investors aiming to gauge the potential for upward momentum in Bitcoin’s price. As Bitcoin approaches these levels, interpretations of market signals and trading volume become crucial in determining whether Bitcoin can sustain its bullish trajectory. The interplay between major exchanges such as Binance and Coinbase also highlights the underlying shifts in trading behaviors among participants within the cryptocurrency space, further impacting Bitcoin’s price movements and overall market health.

In summary, Bitcoin’s price action has garnered attention, particularly with the $65,000 resistance mark identified as a focal point for potential bullish movement. Analysts express cautious optimism regarding the ability to break through this critical level, which could signify a shift in market structure favoring buyers. With significant trading pressure evident on leading exchanges, the current atmosphere suggests a possibility for continued price appreciation if trends consolidate positively in the coming days.

Original Source: cointelegraph.com

Post Comment