Ether Leads Crypto Market Rally Following Fed Rate Cut

The FOMC’s decision to cut interest rates by 50 basis points has catalyzed a bullish rally in the crypto market, with Ether leading with a 14% surge and meme coins experiencing a 40% increase. The U.S. Dollar Index rose above 101, while the weakened yen contributed to positive movements across various risk-on assets, including equities such as Nvidia and the S&P 500. This rally was further supported by significant inflows into crypto ETFs and a notable performance among small-cap cryptocurrencies after initial struggles leading up to the FOMC decision.

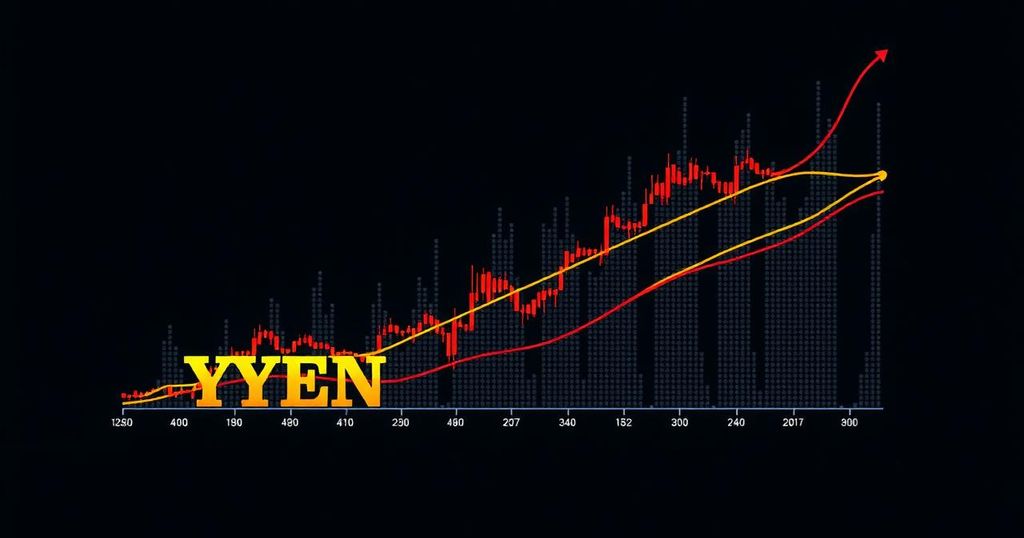

Following a decisive move by the Federal Open Market Committee (FOMC), the cryptocurrency market has experienced a significant rally, led by Ether’s impressive 14% increase. The FOMC’s recent decision to cut interest rates by 50 basis points to a target range of 4.75% to 5.00% has ignited a wave of risk-on sentiment across various asset classes. In addition to Ether, meme coins contributed to a remarkable 40% surge in the crypto market, while Bitcoin saw a modest gain of over 5%, albeit with a decrease in its market dominance to below 58%. The U.S. Dollar Index rose above 101, reflecting a recovery in risk appetite, fueled further by a weakening yen that positively affected cryptocurrencies and other assets alike. In its wake, crude oil prices also surged over 2%, influenced by rising geopolitical tensions in the Middle East. Safe-haven assets such as gold rallied as well, and equities, including Nvidia and the S&P 500 index, embraced the risk-on environment, with gains of approximately 2% and over 1%, respectively. The positive market momentum was further supported by significant inflows into both Ether-based and Bitcoin ETFs, amounting to $8.1 million and $250.3 million, respectively, indicating a renewed interest from investors. Market capitalization groups thrived post-FOMC, with small-cap cryptocurrencies emerging as notable winners. After an initial period of underperformance, all market capitalization groups—large, mid, and small caps—achieved relative highs against Bitcoin, showcasing a shift toward increased risk-taking in financial markets. As the financial landscape anticipates the next FOMC meeting on November 7, the CME Fed Funds futures suggest an even split on possible future rate cuts, hinting at ongoing economic uncertainties on the horizon.

The crypto market’s reaction to the FOMC’s interest rate cut highlights the intricate relationship between monetary policy and investor sentiment within the financial landscape. A historical analysis reveals concerns among market participants regarding the implications of such cuts, particularly considering past economic downturns that accompanied similar decisions. The contrasting perspectives around the recent rate cut indicate a broader debate on the economic outlook, suggesting that while some fear a potential recession, others perceive the possibility of sustainable growth. The broader economic indicators, including GDP growth and lower inflation rates, provide context for understanding the recent market dynamics and risk appetite among investors in various asset classes.

The recent interest rate cut by the FOMC has undeniably invigorated the cryptocurrency market, particularly benefitting assets like Ether and meme coins. As investor sentiment shifts toward risk-on behaviors, various asset classes, including equities and safe-haven commodities, have witnessed positive returns. The positive inflow into crypto ETFs signals a robust resurgence in market interest, suggesting that investors remain optimistic despite potential economic uncertainties ahead. Moving forward, the market will closely monitor developments leading up to the next FOMC meeting, as these decisions will continue to influence financial markets significantly.

Original Source: www.coindesk.com

Post Comment