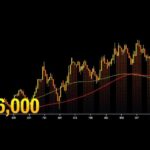

Bitcoin Price Forecast: Consolidation and Key Resistance Levels

The Bitcoin market is currently exhibiting sideways action as it tests the $65,000 resistance level while maintaining support at $62,000. Traders are cautiously engaging in buy-on-the-dip strategies, closely monitoring market dynamics influenced by central bank monetary policies. A breakout above resistance may propel Bitcoin towards $70,000, while a dip below $62,000 could lead to notable declines.

The Bitcoin market is currently experiencing a phase of consolidation, maneuvering through a sideways trend as stakeholders assess the direction of future movements. At present, Bitcoin is oscillating within a known range, specifically pressing against a formidable resistance level situated at the $65,000 mark. There appears to be a prevalent sentiment among traders who are largely adopting a cautious approach, preferring to seek buying opportunities in cases of price dips rather than overextending their positions in this uncertain environment. The critical support level to monitor is around $62,000; a breach below this threshold could potentially trigger a significant decline in market value. However, skepticism exists regarding such a sharp downturn. Observations indicate that central banks across the globe are inclined towards lowering interest rates, a development that is typically favorable for risk assets such as Bitcoin. This scenario suggests that, in due course, traders may gravitate towards cryptocurrency investments as a hedge against weakening fiat currencies. Should Bitcoin manage to surpass the resistance at $65,000, it may signal a bullish trend, potentially propelling the asset towards the $70,000 milestone. In the longer term, the market appears to be establishing a base pattern, yet the requisite momentum for a decisive breakout is not currently present.

Bitcoin, the premier cryptocurrency, remains a focal point in discussions about digital assets as it navigates through horizontal price action in the current market scenario. The significant price levels, namely the resistance at $65,000 and support at $62,000, serve as critical indicators for traders attempting to gauge market strength and potential shifts. This period of sideways movement is indicative of broader market sentiments, influenced by external economic factors, including central bank policies and global monetary trends, which invariably impact investor behavior in risk assets such as Bitcoin.

In conclusion, the Bitcoin market is in a consolidation phase, oscillating between key levels of $65,000 and $62,000 as traders contemplate their strategies. The influence of central bank policies supporting risk assets suggests potential upward momentum, while caution prevails among investors regarding excessive exposure. A decisive breach of the stated resistance or support levels will likely dictate the next movements in Bitcoin’s price, with significant implications for short and long-term investment strategies.

Original Source: www.fxempire.com

Post Comment