Bitcoin Price Target Increased to $78K Following Chinese Stimulus Package

The People’s Bank of China recently announced a liquidity injection of $140 billion, aimed at supporting its economy and real estate market. Analyst Jamie Coutts suggests that this move is bullish for Bitcoin, potentially prompting other central banks to follow suit. Technical indicators imply a possible breakout for Bitcoin, targeting a price of $78,000, although historical trends indicate a need for Bitcoin to rise above $80,000 to achieve new all-time highs adjusted for inflation.

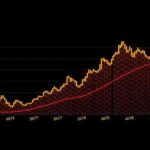

On September 24, 2023, the People’s Bank of China (PBOC) announced a significant liquidity injection of approximately $140 billion into the financial system by reducing the reserve requirement ratio (RRR) by 50 basis points. This monetary policy aims to facilitate lower borrowing costs and amend property purchase regulations to support the ailing real estate market and bolster the overall economy. Jamie Coutts, the Chief Crypto Analyst at Real Vision, believes that this stimulus is favorable for Bitcoin as it may lead other central banks to adopt similar measures. He remarked, “The bottom is in for global central bank liquidity for this cycle. Sit back and watch the other CBs fall into line,” emphasizing that in a credit-based fiat fractional reserve system, asset debasement is expected. Historically, announcements from the PBOC regarding liquidity injection have been precursors to substantial rallies in risk assets, including Bitcoin. For instance, following the $367.7 billion liquidity infusion via reverse repos in October 2023 and the earlier RRR reduction of the same amount in January 2024, Bitcoin’s value surged over 100%. Although the relationship between Chinese liquidity and Bitcoin has been affected by the 2021 crypto mining ban in China, Coutts maintains that the performance of Bitcoin is still largely dependent on global liquidity trends. China’s current easing strategies might incite broader shifts in market risk appetite. Furthermore, the technical analysis indicates the emergence of a bull flag pattern on Bitcoin’s longer-term price chart, suggesting a potential upward breakout. Currently, Bitcoin is testing the upper trendline of this formation, which could pave the way for a price ascent towards $78,000, establishing a new record high. However, should a pullback occur, it may drive Bitcoin’s price toward the lower trendline, aligning closely with the 0.0 Fibonacci retracement level. According to reports from Cointelegraph, Bitcoin’s price may need to exceed $80,000 to reach new all-time highs adjusted for inflation.

The article discusses the implications of a new monetary stimulus package from the People’s Bank of China (PBOC) on the price of Bitcoin. The PBOC’s actions, which include the injection of liquidity into the market, are viewed as potentially bullish for cryptocurrency, particularly Bitcoin, due to the correlation between central bank policies and investment in high-risk assets. This situation arises from a context where global liquidity conditions are crucial for Bitcoin’s performance, especially following regulatory changes in China affecting the cryptocurrency sector.

In conclusion, the recent announcement from the People’s Bank of China regarding a substantial liquidity increase has prompted analysts to forecast a bullish trend for Bitcoin, with a target price of $78,000. The anticipated technical breakout supported by historical trends and market analyses suggests that Bitcoin may experience significant price movements in the near future. Investors are advised to stay informed and consider market dynamics as they make strategic decisions regarding cryptocurrency investments.

Original Source: cointelegraph.com

Post Comment