Bitcoin Price Potential If It Matches Nvidia’s $3.2 Trillion Market Cap

Bitcoin is experiencing a consolidation phase similar to Nvidia’s prior to a significant price increase. If Bitcoin’s market cap reaches $3.2 trillion, its price could rise to approximately $161,917. The ongoing price movements highlight the potential for a breakout from a seven-month trend, possibly mirroring Nvidia’s surge in 2024.

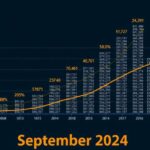

The recent trends observed in Bitcoin’s price consolidation mirror the patterns seen in Nvidia’s stock performance throughout 2023. Both assets underwent a period of lateral movement, which may precede significant price increases. Should Bitcoin replicate Nvidia’s trajectory and its market capitalization ascend to $3.2 trillion, the projected price would approximately reach $161,917. On a relatively calm Saturday, Bitcoin registered a minor decrease of 0.13%, making efforts to maintain its position above the $65,000 threshold. This slight downturn is perceived as a temporary respite, allowing Bitcoin to consolidate above crucial support levels after a three-week surge driven by favorable macroeconomic indicators and renewed investment in Bitcoin ETFs. The prevailing question remains whether the bullish momentum is sufficiently robust to break through the protracted seven-month sideways trend, potentially mirroring Nvidia’s anticipated rally in 2024. The Bitcoin price has been in a consolidation phase for the past seven months, resulting in a prevailing sideways trend within the cryptocurrency market. During this period, Bitcoin’s value has declined by 11%, decreasing from an all-time peak of $73,750 to its current trading price of $65,664. As per data from Coingecko, Bitcoin’s market capitalization stands at $1.297 trillion, with a circulating supply of 19,760,059 BTC. If Bitcoin’s consolidation phase triggers an upward breakout akin to Nvidia’s rally, the value of BTC could surge significantly, leading to a market capitalization of $3.2 trillion and a price point of around $161,917. The correlation between market capitalization and price is crucial to understanding these projections. Should Bitcoin maintain its current circulating supply, an increase to a $3.2 trillion market cap would elevate its price to approximately $161,917. Furthermore, Nvidia’s stock has experienced a considerable uptick in demand, particularly within the AI sector, leading to a 256% increase following a breakout from a six-month consolidation period in early 2024. Comparing the weekly charts reveals that Bitcoin’s price has similarly consolidated, forming what is known in technical analysis as a flag pattern. This chart setup signals potential bullish momentum prior to the next price surge. Thus, if Bitcoin’s price breaks out of its current consolidation, there exists the potential for a similar 200% growth trajectory, potentially elevating its value to $160,000. In conclusion, the combination of institutional investments in Bitcoin ETFs and the overall easing of monetary policies may facilitate Bitcoin’s movement beyond its seven-month consolidation. Should this breakout occur, aligning with Nvidia’s peak at a $3.2 trillion market cap, Bitcoin’s value could escalate to around $161,917.

The cryptocurrency market, particularly Bitcoin, has shown notable price patterns influenced heavily by macroeconomic conditions and institutional investments. Bitcoin’s recent downturn and recovery attempts reflect a larger trend seen in the stock market with companies such as Nvidia, especially in the context of rapid developments in AI technology. Analyzing historical price performances can provide insights into potential future movements for Bitcoin as it navigates through volatile market conditions.

In summary, Bitcoin’s near-term outlook is highly contingent on its ability to emerge from a lengthy consolidation phase. The possibility of achieving a market capitalization equivalent to Nvidia’s peak could result in substantial price increases, reinforcing the importance of observing market trends and economic factors.

Original Source: coingape.com

Post Comment