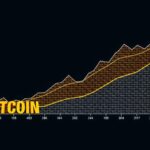

Bitcoin’s Resilient Performance: A Four-Year Review

Bitcoin consistently offers substantial profits, with a CAGR above 50% over four years, surpassing VGT’s performance. The trend shows potential diminishing returns, necessitating careful consideration for future investments as Bitcoin approaches 2025.

Over the course of four years, all investments in Bitcoin have yielded at least a 25% profit. The compound annual growth rate (CAGR) for Bitcoin has remained consistently above 50%, significantly outpacing the Vanguard Information Technology Index ETF (VGT). Between 2016 and late 2024, while the CAGR for Bitcoin has experienced fluctuations, it has continuously outperformed VGT. In 2016, the CAGR for Bitcoin soared above 200% before declining to approximately 50% in early 2017. A resurgence occurred as early as mid-2017, with the CAGR exceeding 150% again in both 2019 and late 2021. Despite a downward shift post-2021, Bitcoin’s CAGR continues to maintain a robust level above 50% entering 2024, despite hitting lows of around 20% to 30% in 2022 and 2023. Looking ahead, should Bitcoin’s price in 2025 not exceed 50% of its 2021 peak—projected around $103,500—it is anticipated that the CAGR will fall below the 50% threshold once more. In contrast, VGT has demonstrated relative stability with a CAGR ranging from 0% to 35% throughout the same period. Notably, during the timeframe between late 2017 and late 2021, VGT eclipsed Bitcoin’s performance, underscoring the rarity of traditional assets surpassing the growth of cryptocurrencies. A Bitcoin engineer, identified by the handle apsk32, emphasized that historical data indicates that no individual has incurred losses by holding Bitcoin over any four-year duration. Nevertheless, the declining trend in Bitcoin’s CAGR may indicate a narrowing opportunity for exceptional returns. While the phase of Bitcoin adoption offers a distinctive financial opportunity, it remains to be seen how substantial future returns may continue to be as growth rates appear to be diminishing.

The analysis of Bitcoin’s performance over four years reveals a consistent pattern of profitability and significant growth, especially when compared to traditional assets such as the Vanguard Information Technology Index ETF (VGT). The historical context of Bitcoin’s rapid increase in value, particularly its peaks and subsequent declines, bolsters the understanding of its volatility and potential for returns.

In conclusion, Bitcoin remains a strong investment with a historical track record of profitability, having consistently achieved a CAGR above 50% over the past four years. However, prospective investors should remain vigilant of the trends indicating a possible decline in this growth rate, particularly as market conditions evolve and the price trajectory of Bitcoin progresses into 2025.

Original Source: cryptoslate.com

Post Comment