BlackRock Supports Emergence of a New Stablecoin Amidst Cryptocurrency Surge

BlackRock is actively endorsing the cryptocurrency ecosystem, backing a new stablecoin (UStb) that will invest in its USD Institutional Digital Liquidity Fund (Buidl). This move is part of a broader strategy to tokenize finance, with the total tokenized asset value expected to reach $16 trillion by 2030. CEO Larry Fink has shifted his stance on Bitcoin, marking it as a legitimate asset as the financial world adapts to these innovations.

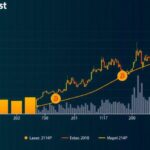

In recent developments within the cryptocurrency landscape, Bitcoin and other digital currencies have experienced significant price increases. This surge is largely attributed to BlackRock, the world’s largest asset manager, whose growing endorsement of Bitcoin has set the stage for a potentially transformative financial product. BlackRock is now backing a new stablecoin aimed at competing with the U.S. dollar, amidst apprehensions of a significant depreciation of the currency. BlackRock’s newly established USD Institutional Digital Liquidity Fund (Buidl) is poised to underpin a new stablecoin launched by the cryptocurrency firm Ethena, known as UStb. This stablecoin is designed to invest its reserves in BlackRock’s Buidl via Securitize, a platform specializing in real-world asset tokenization. Ethena previously introduced a synthetic U.S. dollar stablecoin, USDe, which has seen its circulating supply rise to $2.6 billion. This backing from BlackRock not only provides a robust foundation for UStb but also signifies a pivotal advancement in the ongoing evolution of tokenized finance. BlackRock’s recent endeavors include a strategic investment of $47 million in Securitize, reflecting its broader commitment to the cryptocurrency sector. The firm’s Chief Executive, Larry Fink, has recently acknowledged his shift in perspective regarding Bitcoin, previously regarding it as an instrument linked to illicit practices, but now recognizing it as a valid financial commodity akin to “digital gold.” The investment strategy aligns with BlackRock’s vision of asset tokenization revolutionizing capital markets, encapsulating a forecast that the holistic tokenization of assets could reach a monumental $16 trillion by the year 2030.

The article revolves around a major evolution in the cryptocurrency sector driven by BlackRock’s increasing stake in Bitcoin and the development of digital currencies. In response to fears regarding the U.S. dollar’s future stability, the article highlights BlackRock’s backing of a stablecoin through its USD Institutional Digital Liquidity Fund, emphasizing a strategic shift towards asset tokenization and digital financial instruments. It delves into data reflecting the growing significance of tokenized assets and outlines BlackRock’s expansive influence, given its substantial assets under management and its foray into cryptocurrency investment.

In summary, BlackRock’s strategic involvement in cryptocurrency, particularly through the support of stablecoins like UStb, signals a transformative shift in the financial landscape. This not only underscores the potential of digital assets but also positions BlackRock at the forefront of a burgeoning market anticipated to disrupt traditional financial systems. As tokenization emerges as a critical driver of innovation, the collaboration between leading financial services and cryptocurrency firms like Ethena and Securitize appears set to reshape future capital markets.

Original Source: www.forbes.com.au

Post Comment