Bitcoin’s Near-Term Outlook: Gains Dimming Amid Geopolitical Tensions

Bitcoin ended September with a 7% gain, largely driven by institutional investors, despite showing signs of reduced retail participation. Ongoing geopolitical uncertainties and concerns regarding the Chinese market indicate that Bitcoin may face challenges in achieving new highs. As traders await critical economic updates, heightened market caution prevails in the crypto space, despite a strong historical performance for October.

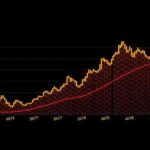

Bitcoin concluded September with a notable 7% increase, reaching approximately $66,000. However, despite this positive momentum, several indicators suggest a looming uncertainty regarding its market trajectory as October approaches. It is essential to note that this recent surge has been largely fueled by institutional investors, whilst retail participation appears to be lacking, which typically indicates a more positive market sentiment. This absence of retail engagement may reflect broader market cooling conditions and geopolitical tensions, particularly surrounding developments in China, that influence investor behavior. The ongoing geopolitical uncertainties, including rising tensions in the Middle East following Israel’s recent military actions, have further dampened market enthusiasm. Investors usually gravitate towards safer assets, such as gold and government bonds, during periods of market volatility, resulting in diminished interest in cryptographic investments. Furthermore, on-chain data reveals a worrying trend for Bitcoin as the supply available to short-term holders is on the decline. Historically, robust retail activity is a hallmark of bullish sentiment; however, the Coinbase app currently ranks 417th in downloads, a significant drop compared to its previous peak position during past booms. This decline in retail engagement indicates that although Bitcoin has appreciated significantly this past month, it may not be indicative of an impending breakout. Despite these challenges, Bitcoin maintains a strong performance throughout September, marking its highest monthly gain since 2013. Market participants eagerly await upcoming economic indicators, including job data and Federal Reserve Chairman Jerome Powell’s insights regarding potential interest rate adjustments, which could further influence the financial landscape.

Bitcoin, a leading digital currency, has experienced varied market dynamics influenced by institutional and retail investors alike. Historically, the cryptocurrency market exhibits strong performance patterns during certain months, notably October, which has been dubbed “Uptober” due to consistent positive returns. However, the recent September rally has prompted scrutiny regarding its sustainability against the backdrop of geopolitical tensions and low retail interest. The behavior of major stablecoins, particularly in markets like China, reveals critical insights that underscore investor sentiment and market health. Furthermore, the shifting economic landscape due to international developments and central bank policies adds a layer of complexity to Bitcoin’s trajectory as it approaches the final quarter of the year.

In conclusion, while Bitcoin has demonstrated a commendable rally of 7% in September, key indicators suggest a complicated path ahead as October unfolds. Institutional support has played a significant role in driving prices, yet the lack of retail interest, combined with ongoing geopolitical tensions, indicates potential vulnerabilities in the market. Investors should remain vigilant, monitoring not only Bitcoin’s performance but also broader economic conditions that could shape the digital currency landscape in the near future.

Original Source: cryptobriefing.com

Post Comment