Analyst Predicts Bitcoin Recovery Amid Market Volatility

Bitcoin has experienced a 6% decline to $61,000, attributed to geopolitical tensions and economic uncertainty. Quinn Thompson from Lekker Capital recommends purchasing Bitcoin, predicting a potential rebound based on historical trends. Despite current market volatility, historical data suggests that Bitcoin often rallies in October, presenting a cautiously optimistic outlook for investors.

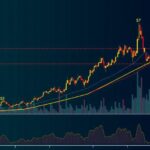

Bitcoin has recently seen a drop of 6%, settling at $61,000, influenced by geopolitical tensions and economic uncertainties; however, Chief Investment Officer Quinn Thompson from Lekker Capital advocates for purchasing Bitcoin at this price, believing it to be a strategic buying opportunity. He highlights historical trends where Bitcoin tends to recover and rally during late October despite early month setbacks. Thompson, in his analysis shared on X (formerly Twitter), presented a chart showcasing Bitcoin’s price movements since it peaked at $73,700 on March 5, 2024. He emphasized the current market situation where Bitcoin rapidly rebounded after momentarily dipping below its 200-day moving average—a crucial indicator of mid-term strength for traders. He interprets this bounce back as indicative of a fundamental change in the economic landscape, with the expectation that Bitcoin prices will rise again soon. The backdrop of recent geopolitical strife, particularly the military actions of Iran against Israel, has exacerbated market volatility and contributed to the sell-off of risk assets, including Bitcoin. Concerns regarding the resilience of the US economy amidst uncertainty, particularly surrounding the impending November elections, have further dampened investor confidence. Consequently, the anticipated performance of “Uptober” has fallen short, as illustrated by dwindling mentions on social media. Despite a lack of widespread optimism, some analysts, including Maksim Balashevich from Santiment, echo Thompson’s sentiments regarding potential recovery, albeit with caution concerning the end of the protracted downtrend. Historically, the cryptocurrency market tends to exhibit robust performance in October, averaging gains of over 20% in the past decade, typically surging in the latter half of the month. Last year illustrated this pattern, with Bitcoin experiencing a significant rebound following an early October dip. Thompson’s assertion to seize the opportunity presented by the current price dip aligns well with historical data, positioning the market at a juncture of potential recovery. As investors navigate this fluctuation, it is essential to consider both inherent risks and rewards, particularly as global events and economic signals will likely shape market strategies moving forward. In conclusion, the upcoming weeks will be pivotal in determining whether Bitcoin will follow its traditional October upward trend or carve a new financial trajectory.

The cryptocurrency market, particularly Bitcoin, is influenced by various external factors, including geopolitical events and economic shifts. Recent tensions in the Middle East, along with uncertainties surrounding the US economy and upcoming elections, have introduced increased volatility among cryptocurrencies. This market behavior is compounded by historical patterns that often see Bitcoin rallying in late October, although it may experience declines in the earlier part of the month. Understanding these dynamics is crucial for investors who are looking to make informed decisions during periods of uncertainty and fluctuations in the market.

In summary, Bitcoin’s recent price drop to $61,000 presents what analysts like Quinn Thompson deem a significant buying opportunity. Historical trends suggest that this period often precedes a rebound, especially as past data indicates strong performance in October. While geopolitical tensions and economic uncertainties contribute to current market volatility, the potential for an upward trend remains notable. Investors are advised to remain vigilant, weighing the risks and rewards as the month progresses.

Original Source: www.coinspeaker.com

Post Comment