Current Analysis of Bitcoin Price Movements Above $60,000

Bitcoin’s price is currently above $60,000 but has faced obstacles in surpassing the $65,000 resistance level. The market shows volatility and uncertainty, as indicated by recent price action and doji candlesticks. Critical support and resistance levels will dictate potential future movements in Bitcoin’s price trajectory.

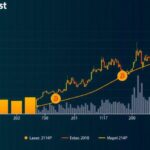

The Bitcoin (BTC) price currently remains above $60,000 but has encountered challenges in maintaining upward momentum after failing to surpass the crucial resistance level of $65,000. Speculation among investors suggested that a breakthrough at $65,000 could pave the way for Bitcoin to reach the significant psychological mark of $70,000. However, on September 29, Bitcoin experienced a notable rejection at a peak of $66,193, following which it dipped below the moving average lines, yet still managed to stay above the 50-day Simple Moving Average (SMA). Since October 1, Bitcoin’s price has remained relatively stable, oscillating above the $60,000 threshold and maintaining its position above the 50-day SMA support level. The past few days have exhibited a lack of decisive movement in price action characterized by the presence of doji candlesticks, which suggest indecision among traders regarding the market’s next direction. If Bitcoin fails to hold the 50-day SMA support or dips below the $60,000 mark, there exists a potential for further decline. Conversely, an upward trend may materialize if market buyers can breach the 21-day SMA resistance line. Presently, Bitcoin trades at approximately $61,262. Following the recent price drop, Bitcoin has stagnated between the moving average lines as buyers struggled to propel the price past the high of $70,000, with upward momentum significantly hindered at the $65,000 level. Should the 50-day SMA support not hold, Bitcoin risks falling more substantially. Resistance levels are identified at $70,000 and $80,000, while support levels are located at $50,000 and $40,000. The 4-hour chart indicates Bitcoin is trading below the moving average lines yet remains above the $60,000 support level. In recent trading days, long candlestick tails have developed indicating persistent buying pressure around the $60,000 support due to significant interest at lower price points.

The cryptocurrency market has been exhibiting fluctuating prices, particularly Bitcoin, which is often seen as a benchmark for the sector. Bitcoin’s price behavior is reactive to various market dynamics and psychological barriers, as observed in its recent attempts to break through the $65,000 mark. Understanding these movements, including the formation of technical indicators like the doji candlesticks and moving averages, provides insight into traders’ sentiments and potential future trends in the market.

In summary, Bitcoin’s price is currently holding steady above $60,000, influenced by the recent inability to cross the $65,000 resistance level. With doji candlesticks signaling uncertainty among traders, the market remains poised for critical movements depending on whether the 50-day SMA support holds or if buyers can successfully breach higher resistance levels. Traders are urged to exercise caution and diligence in their investment decisions given the prevailing market dynamics.

Original Source: coinidol.com

Post Comment