U.S. Employment Strengthens with 254K New Jobs in September, Unemployment Rate Falls to 4.1%

The U.S. added 254,000 jobs in September, significantly surpassing expectations and lowering the unemployment rate to 4.1%. This strong performance reduces the likelihood of a substantial interest rate cut by the Federal Reserve in November. Bitcoin prices climbed modestly following the report, reflecting increased market confidence amid a resilient labor market.

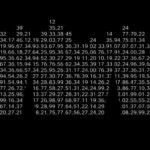

The United States experienced a remarkable surge in employment in September, with the addition of 254,000 new jobs significantly exceeding the expectations of economists who had predicted an increase of only 140,000 jobs. This substantial growth prompted the unemployment rate to decrease from 4.2% in August to 4.1%, which also surpassed the anticipated figures. Additionally, the previously reported job gains for August were revised upwards from 142,000 to 159,000. In the aftermath of this positive labor market report, the Federal Reserve’s upcoming policy meeting in November will likely see a reduction in interest rates by only 25 basis points, reducing the prospect of a more aggressive 50 basis point cut. Market reactions included a slight rise in Bitcoin prices, which were trading around $61,500, reflecting an increase of approximately 1.5% within the past 24 hours. However, Bitcoin remains lower than its previous week’s levels of over $66,000, which experienced considerable volatility influenced by various macroeconomic factors, including geopolitical tensions in the Middle East. Moreover, average hourly earnings showed a 0.4% increase in September, outpacing forecasts of 0.3%, but slightly slowing from a 0.5% increase in August. Year-over-year, average hourly earnings rose by 4.0%, compared to expectations of 3.8% and 3.9% in August. Following the data release, expectations regarding interest rate cuts diminished significantly; the probability of a 50 basis point reduction fell to 11%, while the odds for a 25 basis point reduction increased to 70%. With respect to traditional financial markets, U.S. stock index futures reacted positively by extending gains, with the Nasdaq 100 rising by 0.8%. Concomitantly, the yield on the U.S. 10-year note rose by eight basis points to reach 3.94%, and the U.S. dollar index saw a notable increase of 0.5%, while gold prices experienced a slight decline of 0.5% to $2,665 per ounce.

The employment report for September 2023 indicates a robust labor market in the United States, highlighting the ability of the job sector to rebound and expand even amid various economic challenges. This employment growth has critical implications for monetary policy as the Federal Reserve assesses the economy’s health in relation to interest rates. The data serves as a strategic indicator that influences expectations of potential rate cuts, highlighting a shift away from aggressive measures towards a more tempered approach to monetary policy. Moreover, the implications for cryptocurrency markets, particularly Bitcoin, demonstrate how traditional economic indicators can significantly affect digital asset performance. The favorable employment numbers not only bolster confidence in the U.S. economy but also alleviate some of the risks previously surrounding market volatility.

In conclusion, the September employment report indicates substantial job growth in the United States, dispelling fears of an imminent economic downturn. The decrease in the unemployment rate and the upward revision of prior job figures underscore the resilience of the labor market. Furthermore, this upbeat employment picture affects expectations surrounding the Federal Reserve’s monetary policy, potentially limiting the scope for aggressive rate cuts. Consequently, traditional markets responded positively to these developments, contributing to a more optimistic economic outlook moving forward, particularly in the context of the upcoming 2024 election and its potential impact on fiscal policy.

Original Source: www.coindesk.com

Post Comment